Fundamental Overview

The USD came under pressure since Friday following the softer than expected US CPI report and then the US-China preliminary deal over the weekend. Overall, the market pricing didn’t change much as it was already very dovish going into the CPI and the trade talks, but given the positive risk sentiment, the greenback continues to stay on the backfoot.

The risk-on sentiment is expected to weigh on the dollar in the short-term, although Treasury yields could also erase the drop triggered by Trump’s escalation a couple of weeks ago. This could create some tension between bullish and bearish drivers, but for now there’s no strong reason for the dollar to rally amid the lack of key US data.

The Fed tomorrow is widely expected to cut by 25 bps and announce an end to QT. They will likely keep the status quo given the lack of US data in terms of forward guidance. For this reason, the decision is likely to be a non-event considering that we won’t even get the SEP.

On the AUD side, the commodity currency jumped at the start of the week as the preliminary US-China deal over the weekend lifted the risk sentiment. Moreover, the RBA Governor Bullock yesterday delivered some hawkish comments that sounded like a rate cut at the upcoming meeting wasn’t certain at all.

The market scaled back the rate cut probability from 60% to 40%. Tomorrow, we have the Australian quarterly inflation report and that could still put a rate cut on the table if the data misses RBA’s forecast of 0.6% rise in the Trimmed Mean Q/Q measure. On the other hand, Bullock said that a 0.9% would represent a material miss and therefore take a rate cut off the table completely.

AUDUSD Technical Analysis – Daily Timeframe

On the daily chart, we can see that AUDUSD broke above the major downward trendline yesterday opening the door for a rally into the 0.6627 level next. The buyers piled in on the break and will now target the 0.6627 level. The sellers, on the other hand, will want to see the price falling back below the trendline to step back in and position for a drop into new lows.

AUDUSD Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we have an upward trendline defining the bullish momentum. If we get a pullback into the trendline, we can expect the buyers to lean on it with a defined risk below it to position for a rally into the 0.6627 level next. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 0.6440 level.

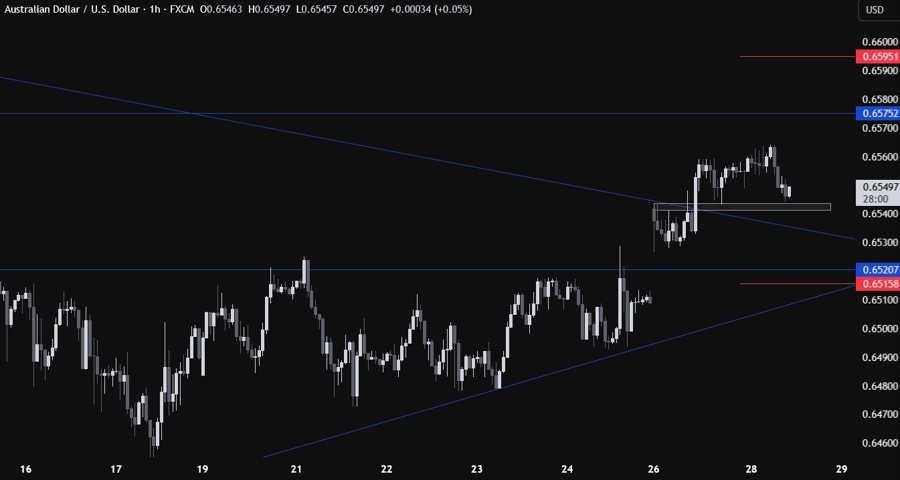

AUDUSD Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that the price bounced on the minor support zone around the 0.6545 level. If the price were to fall below the support, we can expect the sellers to pile in for the pullback into the trendline. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrow we have the Australian quarterly inflation report and the FOMC policy decision. On Thursday, we have the Trump-Xi meeting.