Key Takeaways for New Traders and Investors

Headlines around trade and housing look negative, but markets often move before headlines change.

Canada’s economy has shown unexpected resilience, especially consumer spending.

Political and institutional stability matters more than most people realize for currencies.

A single U.S. Supreme Court ruling could quietly reshape global capital flows in 2026.

This article is based on insights from Chief Currency Analyst at investingLive.com, Adam Button as recently interviews on BNN Bloomberg TV (watch below), and is designed to help newer market participants understand what actually drives currencies beyond daily news noise. We go a bit further to break it down for the non experts as well.

Introduction: Why Currency Headlines Can Be Misleading

If you only follow headlines, 2026 looks uncomfortable for Canada.

Trade tensions with the U.S., concerns about the housing market, and constant political drama dominate the news flow. For many beginners, that automatically translates to: “The Canadian dollar must be weak.”

But markets do not price emotions. They price probabilities, capital flows, and relative stability.

When we step back and look at the bigger picture, several underappreciated forces suggest the Canadian dollar (CAD) may be stronger than expected over the year ahead.

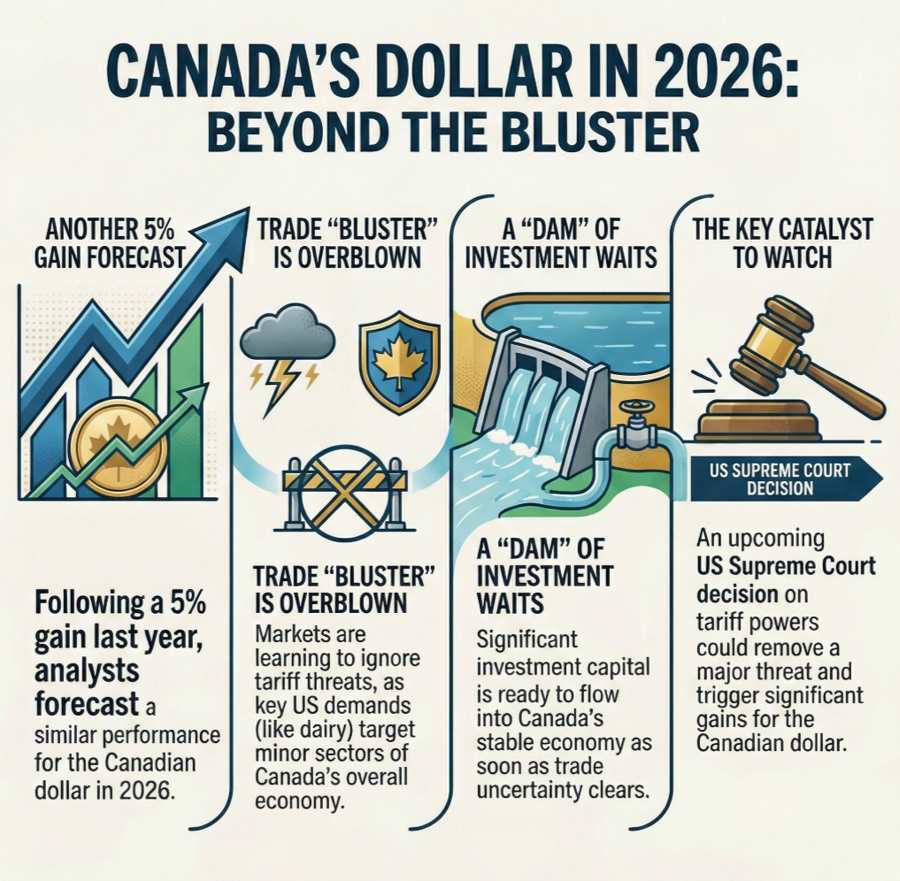

1. U.S.-Canada Trade Tension: Loud Headlines, Limited Economic Damage

For new investors, it is important to understand this rule:

Markets care more about outcomes than about threats.

Yes, Donald Trump continues to use aggressive trade rhetoric. But behind the scenes, policy actions matter far more than public statements.

According to Adam Button, U.S. officials have signaled a desire to remain within the USMCA framework. Even the most criticized trade issues, such as dairy access, are not large enough to destabilize Canada’s overall economy.

Why this matters for CAD

Businesses delay investments when rules are unclear.

Once trade rules are confirmed, delayed capital often floods in quickly.

This creates what Button describes as a “dam of investment capital” waiting for clarity.

For traders, this means uncertainty can suppress a currency temporarily, but resolution often leads to sharp, fast revaluations.

2. The Canadian Consumer Did Not Collapse With Housing Prices

Many beginners assume:

Falling house prices automatically cause economic crashes.

Canada challenged that assumption in 2025.

Despite housing price declines of 10% to 20% in some regions, consumer spending stayed strong. Shoppers did not suddenly stop spending, traveling, or living normally.

Why this is important

It suggests households were not overleveraged in day-to-day spending.

Consumer resilience reduces recession risk.

Banks remain healthier than feared.

This confidence showed up in markets when Canadian bank stocks rallied strongly in the second half of 2025, signaling that investors do not expect a U.S.-style housing collapse.

For long-term investors, this supports the idea that Canada’s economy is slowing, not breaking.

3. Canada’s “Boring” Politics Are a Hidden Advantage

This is one of the most overlooked concepts for newer traders.

Currencies are not just about interest rates. They are about trust.

In a world filled with political shocks, Canada offers something increasingly rare:

Predictable elections

Stable institutions

Policy continuity regardless of which party wins

Button notes that while the U.S. and U.K. face deep political uncertainty, Canada’s outlook is relatively straightforward.

Why stability strengthens a currency

Long-term investors prefer countries where rules do not suddenly change.

Capital-intensive projects like oil, mining, and infrastructure need decades, not quarters.

Stability lowers risk premiums demanded by investors.

This type of stability often supports a currency quietly and gradually, which is why it is frequently underpriced.

4. A U.S. Supreme Court Decision Could Reshape Global Markets

This is the biggest wildcard of 2026.

A pending decision by the Supreme Court of the United States will determine how much power a U.S. president has to impose tariffs without congressional approval.

Two very different outcomes

Scenario 1: Tariff powers are limited

Confirms institutional checks and balances.

Restores confidence in U.S. governance.

Reduces panic-driven capital flows into gold and defensive assets.

Stabilizes global currencies, including CAD.

Scenario 2: Tariff powers are upheld

Raises concerns about institutional erosion.

Increases global uncertainty.

Supports further strength in gold and alternative assets.

Encourages diversification away from U.S.-centric exposure.

Either way, this decision will likely set the tone for capital flows across 2026, indirectly affecting the Canadian dollar.

Conclusion: Learning to Look Past the Noise

For new traders and investors, this is the key lesson:

Markets reward those who look ahead, not those who react to headlines.

Canada enters 2026 with:

A resilient consumer

Stable political institutions

Manageable trade risks

A global environment where stability is increasingly valuable

As Adam Button noted, after a roughly 5% gain in the Canadian dollar last year, a similar move in 2026 is entirely plausible.