FUNDAMENTAL OVERVIEW

Oil prices plunged late yesterday following a comment from Trump where he said that the killing in Iran was stopping and that there were no plans for executions. For some context, Trump has been threatening “strong actions” in case the Iranian regime killed protestors.

We’ve been getting reports of mass killings and executions in the past days, which prompted Trump to cancel all the meetings with Iran's officials and pledging support to the protestors. This kept oil prices supported on escalating US-Iran tensions.

Yesterday’s comment eased the geopolitical risk premium as the fears of an imminent military action subsided. The concerns eased further this morning as the Iranian airspace slowly returned to regular traffic following a previous block due to potential US strikes.

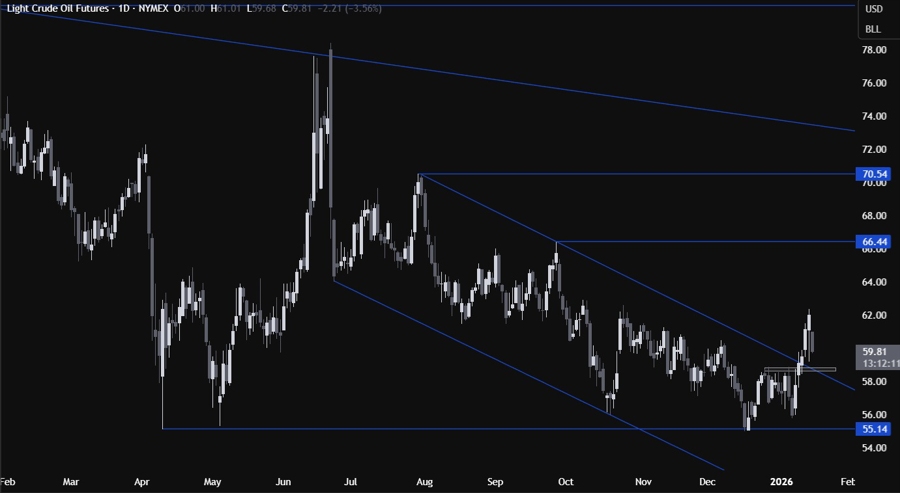

CRUDE OIL TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see the drop in the price from the $62.00 level. We have a strong support zone around the $58.80 level where we can expect the buyers to step in with a defined risk below the support to target a rally into the $66.00 level. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the $55.00 level next.

CRUDE OIL TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see more clearly the quick drop following Trump's comment on Iran. There's not much we can add here as from a risk management perspective, the buyers will have a better risk to reward setup around the $58.80 support to target new highs, while the sellers will need a break lower to open the door for new lows. The red lines define the average daily range for today.