TD Cowen is out with a bullish report on the metals complex, arguing the macroeconomic setup for the next several years is the strongest in years. The core thesis rests on chronic underinvestment colliding with supply deficits, creating a particularly favorable environment for copper and uranium.

The supply side of the copper equation is tightening significantly. Supply growth in 2025 fell to just 1.4%, marking the lowest levels since the pandemic. This output gap is the cumulative result of years of insufficient capital expenditure and recent high-profile mine disruptions. Consequently, forecasts for copper deficits have been extended through 2027, prompting a revision of the long-term copper price assumption to $5.00/lb from $4.50/lb.

"We do not believe that new supply will enter the market unless spot pricing remains above $5.00/lb at a minimum," TD writes.

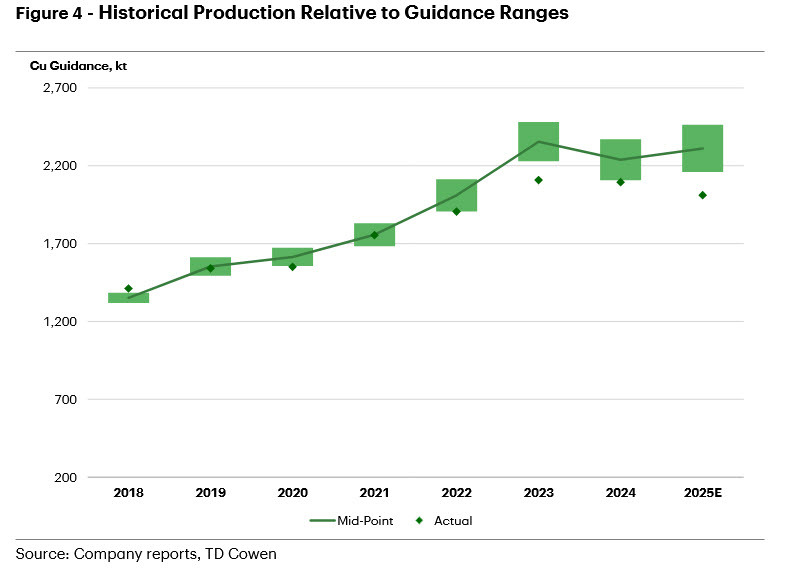

A big change from last year was a combination of poor execution and disasters at a number of mines that led to underproduction, including Teck's QB mine, Ivanhoe's Kamoa-Kakula, Freeport's Grasberg, and Codelco's El Teniente.

We estimate that total 2025 production for our coverage universe will fall 13% below the midpoint of the original guidance ranges.

Much of that will bleed into this year.

TD highlights estimates from Wood Mackenzie:

Heading into 2026, Wood Mackenzie now forecasts a supply deficit of 320kt. The deficit has grown ~85% since Q3, largely reflecting the implementation of Grasberg's ~270kt loss in 2026. The market will be focused on any delays in restoring production towards Grasberg's targeted steady state of 725kt per year in 2027-2029. Recovery delays could drive copper prices higher than our forecasts

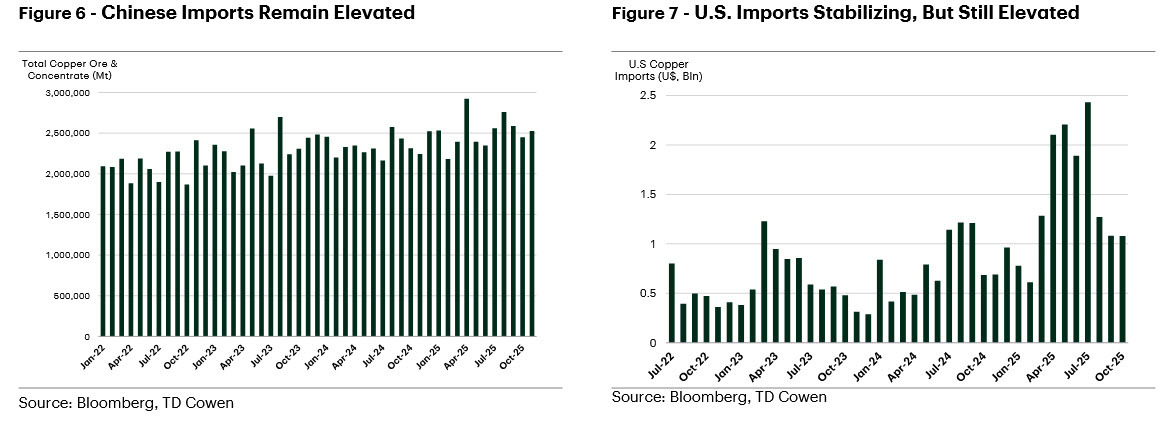

Eyes are also on China, which consumes about 55% of global copper supply. So far, EV demand is helping to compensate for a moribund property market but in 2026, they see just 0.9% consumption growth, falling to near 0% by 2029.

Uranium is also seeing upward revisions, with long-term price targets raised to $90/lb. The sector is benefiting from a wave of new reactor build announcements, particularly in the US, and government efforts to secure critical mineral supply. This will keep the physical market tight despite equities already trading at record valuations.

In the equity space, the focus is on producers with advantageous cost structures. Top picks include Capstone, Hudbay, and Lundin Mining. For Hudbay and Lundin specifically, the strength in gold prices is providing significant by-product credits, effectively lowering their cash costs while they capitalize on the copper rally. M&A activity remains a key theme to watch, highlighted by ongoing merger talks in the sector and the expected closure of the Anglo-Teck combination later this year.

On the downside, they say investors should remain wary of the iron ore market, which faces a divergence from the rest of the complex. A supply surplus is anticipated in 2026 as the Simandou project ramps up, likely weighing on prices. Additionally, trade policy remains a variable, with potential U.S. copper tariffs expected to be a topical issue leading into a mid-year decision.

Here are the main forecast changes:

Copper: 2026 forecast raised to $5.50/lb (from $5.25/lb); Long-Term forecast raised to $5.00/lb (from $4.50/lb).

Gold: 2026 forecast raised to $4,650/oz (from $3,900/oz).

Silver: 2026 forecast raised to $73/oz (from $46/oz).

Uranium: 2027 forecast raised to $95/lb (from $90/lb); Long-Term forecast raised to $90/lb (from $85/lb).

Zinc: 2026 forecast raised to $1.38/lb (from $1.20/lb).

Nickel: 2026 forecast raised to $7.56/lb (from $7.00/lb).

Iron Ore: 2026 forecast (62% Fe) lowered to $98/t (from $100/t).