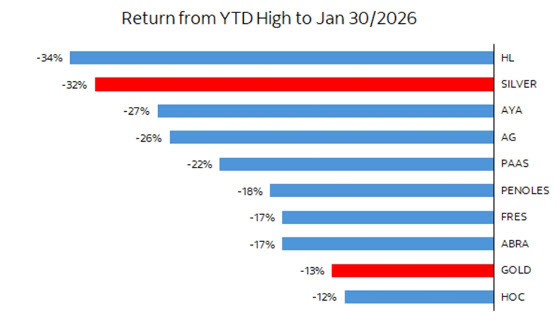

Silver experienced its worst single-day loss in over four decades last Friday, plummeting nearly 30% to settle just below $85/oz. Gold didn't escape the carnage either, shedding more than $500/oz to close at $4,865/oz. Despite the dramatic selloff, Scotia Capital's precious metals team is viewing this as a healthy correction rather than a fundamental shift in the market.

The analysts characterize the move as removing "speculative froth" that had gripped silver in recent weeks. What's striking is how little ground was actually lost in the broader context—silver prices have only retraced to mid-January levels, roughly 14 trading days ago. For gold, the retracement spans just six trading days, underscoring how parabolic the recent rally had become.

Scotia's team argues that the core drivers supporting silver remain intact. They're maintaining their top picks of Pan American Silver (PAAS) and Hochschild Mining (HOC-LON), pointing to robust profit margins for miners. Their covered silver producers are sitting on all-in sustaining costs ranging from $20/oz to $28/oz, which leaves substantial breathing room even after the correction. Free cash flow yields for these companies average around 10% at current spot prices for 2026.

The market mechanics tell an interesting story. The one-month silver lease rate has dropped below 1%, suggesting physical tightness has eased following the postponement of US tariffs under the Section 232 investigation. COMEX silver inventories stand at 406 million ounces, down from recent highs above 500 million ounces as market participants had been positioning for potential tariff impacts.

The gold-to-silver ratio has rebounded to 53:1 as of Friday from the low 50s earlier in the week. Exchange-traded product holdings have declined by approximately 33 million ounces since the start of January when they stood at 1.26 billion ounces. Much of the action played out through the SLV ETF, which saw extraordinary volume exceeding 500 million shares on Friday alone.

Scotia notes that COMEX futures and options positioning shows a declining net long position, likely driven by increased margin requirements that squeezed out leveraged speculators. This is textbook deleveraging, and the analysts expect continued volatility in the weeks ahead as speculative positioning continues to unwind.

Silver has averaged around $91/oz quarter-to-date, which still provides healthy margins for producers if prices stabilize at elevated levels. The team describes their outlook as "stronger for longer" for silver prices, even accounting for the recent volatility. Historical context matters here—despite the selloff, silver remains well above its trading range from the past several decades.

They note that free cash flow yields have actually improved following Friday's equity corrections, as the equities fell hard.

The fundamental scarcity of high-quality primary silver mines remains a supportive factor for the sector. With production costs well below current prices and strong cash flow generation, Scotia sees the mining companies as well-positioned to weather the volatility. Their mixed rating reflects the near-term uncertainty around price action while maintaining conviction in the longer-term outlook for both the metal and quality producers.

Details:

Pan American Silver (PAAS-Q)

Rating: Sector Outperform (SO)

Price (Jan 30, 2026): US$54.60

1-Year Price Target: US$64.00

Valuation Context: The report highlights that PAAS remains a top pick, supported by a robust profit outlook for miners and strong forecast Free Cash Flow yields.

Hochschild Mining (HOC-L)

Rating: Sector Outperform (SO)

Price (Jan 30, 2026): GBP 6.76

1-Year Price Target: GBP 9.00

Risk Profile: Key risks identified include volatility in gold and silver prices, geopolitical risks, and potential operational issues at Peruvian and Brazilian sites.