Russian crude discounts to China have hit record levels as sellers chase demand amid uncertainty over India’s future imports.

Summary:

Discounts on Russian crude exports to China have widened to record levels as sellers cut prices to retain demand amid the risk of losing Indian buyers.

The move follows a US–India trade agreement that includes a halt to Indian purchases of Russian oil, though timing and enforcement remain unclear.

Analysts say China’s independent refiners are absorbing most displaced Russian barrels, benefiting from deeper discounts and higher margins.

However, analysts warn China’s capacity to take additional Russian crude is not unlimited, with state refiners still largely sidelined.

Market focus is now on whether further discounting can sustain flows, or whether oversupply pressures will intensify.

Discounts on Russian oil exports to China widened to fresh records this week as sellers slashed prices to attract demand from the world’s top crude importer, according to traders, following signals that India may sharply curb purchases of Russian oil.

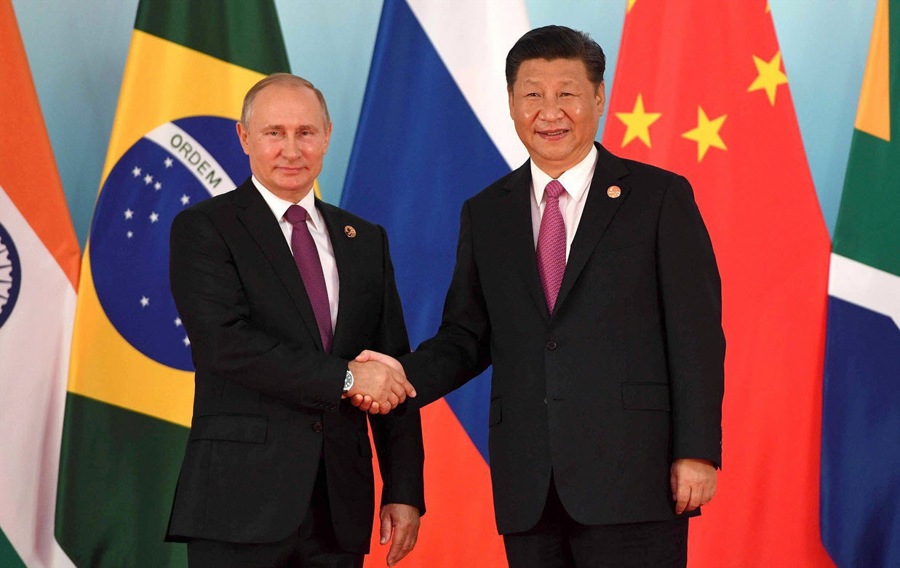

The price cuts come after US President Donald Trump announced a trade agreement with Indian Prime Minister Narendra Modi that included halting Indian imports of Russian crude. While details on timing and enforcement remain unclear, the announcement has raised concerns that Russia could lose one of its key buyers.

If India were to fully step back, China would effectively become the only major outlet for discounted Russian oil. Russia, the world’s second-largest crude exporter, is already grappling with weaker Indian demand linked to Western sanctions, with volumes of Russian oil in floating storage rising.

Analysts at JPMorgan said their base case is that India will continue importing 800,000 to 1 million barrels per day of Russian crude — down sharply from a peak of around 2 million bpd last June — accounting for roughly 17–21% of its total imports. Even so, displaced barrels are increasingly being diverted toward China.

Discounts for Russia’s ESPO Blend delivered to China have widened to nearly $9 a barrel versus ICE Brent, up from $7–$8 in recent months, traders said. Discounts on Urals crude, typically shipped from the Baltics to India, are hovering around $12 a barrel and could widen further.

Analysts say Chinese independent refiners, particularly in Shandong province, have been the main beneficiaries, boosting margins, runs and strategic stockpiles. However, China’s ability to absorb additional Russian supply may be nearing its limits without renewed buying from state refiners, which have largely paused seaborne Russian purchases since US sanctions on Rosneft and Lukoil.

---

Wider discounts on Russian crude are likely to act as a soft cap on global oil prices, even if headline Brent and WTI benchmarks remain supported by geopolitics or OPEC+ discipline. Heavily discounted Russian barrels increase competition in Asia, pressure Middle Eastern grades, and dilute the impact of supply risks elsewhere.

If India’s pullback deepens and China becomes the marginal buyer, Russia may be forced to keep cutting prices to clear supply, effectively exporting deflation into the physical market. That dynamic could weigh on Asia-linked benchmarks and refining margins outside China, while limiting upside for global prices unless broader supply tightness emerges.

At the macro level, persistent discounting raises the risk of inventory build-ups, floating storage and weaker price transmission, keeping oil markets volatile but range-bound rather than structurally tight.