It's tough to separate the rhetoric from the reality of the US oil market.

The big question at the moment is: What happens to US production at $65/barrel oil? Certainly, there are parts of the shale industry that make plenty of money at those prices but what about the marginal producer?

Critically, shale is a treadmill and production falls rapidly if new wells aren't drilled. That could lead to a rapid rebound in oil prices (and inflation) in the future.

With that in mind, here are the survey highlights from the report:

- Business activity index -6.5 vs -8.1 prior

- Company outlook index -17.6 vs -6.4 prior

- Production index -8.6 vs -8.9 prior

- Capex -11.9 vs -3.0

- Input costs +34.8 vs +40.0

- Finding and development costs +22.0 vs +11.4 prior

- Oilfield services utilization index -13.0 vs -4.6 prior

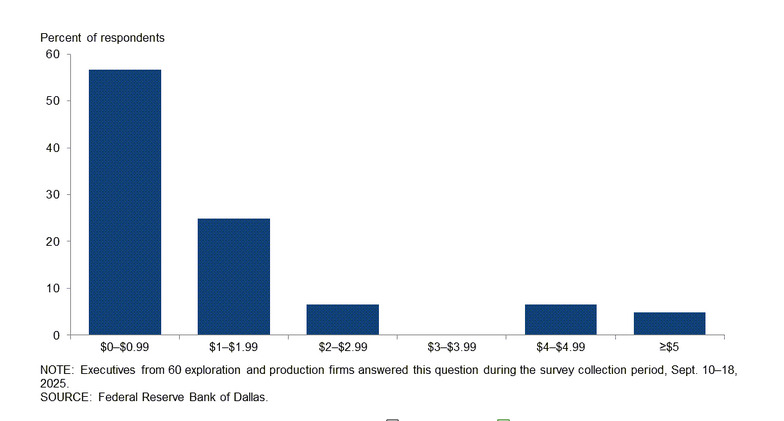

The US administration policy of 'drill, baby, drill' has had some effects but nowhere near enough to offset the $8/barrel drop in oil prices since the start of the year. In a special question, companies were asked "How much do you estimate regulatory changes since January 2025 have reduced your firm’s break-even cost for new wells on a dollar-per-barrel basis?"

The majority of executives at large E&P firms also said they expect no change to US production on Federal lands over the next five years due to lower royalty rates in the One Big Beautiful Bill Act.

36% of firms said they had significantly delayed investment decisions in response to uncertainty and lower oil prices with another 42% saying they had delayed them slightly.

Selected comments from respondents:

- The administration is pushing for $40 per barrel crude oil, and with tariffs on foreign tubular goods, [input] prices are up, and drilling is going to disappear. The oil industry is once again going to lose valuable employees

- The administration is pushing for $40 per barrel crude oil, and with tariffs on foreign tubular goods, [input] prices are up, and drilling is going to disappear. The oil industry is once again going to lose valuable employees.

- The noise and chaos is deafening! Who wants to make a business decision in this unstable environment?

- The uncertainty from the administration’s policies has put a damper on all investment in the oilpatch. Those who can are running for the exits. Tobin’s q < 1.

- The U.S. shale business is broken. What was once the world’s most dynamic energy engine has been gutted by political hostility and economic ignorance. The previous administration vilified the industry, buried it in regulation and cheered the flight of capital under the environmental, social and governance banner. Wall Street and pension funds walked away, and even private equity shifted from fueling growth to engineering exits. Now the current administration is finishing the job. Guided by a U.S. Department of Energy that tells them what they want to hear instead of hard facts, they operate with little understanding of shale economics. Instead of supporting domestic production, they’ve effectively aligned with OPEC—using supply tactics to push prices below economic thresholds, kneecapping U.S. producers in the process. The collapse of capital availability has fueled consolidation by the majors, pushing out independents and entrepreneurs who once defined the shale revolution. In their place, a handful of giants now dominate but at the cost of enormous job loss and the destruction of the innovative, risk-taking culture that made the U.S. shale industry great

- Because of global circumstances we think crude oil prices will stay low at the $60 per barrel level. Alternatively, because of an increase in the LNG market we feel that natural gas development and production will increase.

- While crude prices have stabilized in the low-$60s per barrel, the expectation of higher prices is still present. Because of that, a stable price in the low-60s has increased uncertainty due to the expectation of low-60s well into 2026 if not beyond. Costs have been relatively flat and we're not seeing the efficiency gains that are being reported elsewhere in the Permian. With all of that, our expectation is to manage our lease expirations but not drill unnecessary wells in this price environment.