The oil folks seem to have packed it in for the year, this via a telegram channel:

--

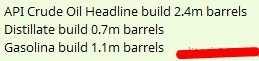

Expectations I had seen centred on:

- Headline crude -2.4 mn barrels

- Distillates +0.4 mn bbls

- Gasoline +1.1 mn

---

This data point is from a privately-conducted survey by the American Petroleum Institute (API).

- It's a survey of oil storage facilities and companies

- The official government inventory report is due Wednesday morning US time.

The two reports are quite different.

The official government data comes from the US Energy Information Administration (EIA)

- Its based on data from the Department of Energy and other government agencies

- Whereas information on total crude oil storage levels and variations from the previous week's levels are both provided by the API report, the EIA report also provides statistics on inputs and outputs from refineries, as well as other significant indicators of the status of the oil market, and storage levels for various grades of crude oil, such as light, medium, and heavy.

- the EIA report is held to be more accurate and comprehensive than the survey from the API

---

The oil price has climbed this week. Oil prices found early support on Monday as a renewed uptick in geopolitical risk helped rebuild a modest risk premium in crude markets. Over the weekend, the United States intercepted a Venezuelan oil tanker, underscoring Washington’s willingness to more actively enforce sanctions and adding to concerns around potential supply disruptions from the region. While the immediate impact on global supply remains limited, the episode served as a reminder of lingering geopolitical fault lines in key energy-producing areas.

At the same time, tensions in the Middle East remained elevated, with the standoff between Israel and Iran continuing to simmer. Although no fresh escalation was reported, the persistence of regional uncertainty has been enough to keep traders cautious, particularly given the strategic importance of Middle Eastern supply routes and infrastructure.

Together, these developments helped stabilise prices after recent declines, with markets modestly rebuilding a geopolitical risk premium. Gains have extended somewhat as the week has progressed. .