Via oilprice.com:

---

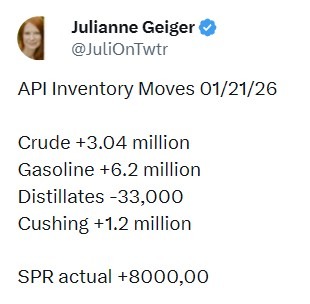

Expectations I had seen centred on:

- Headline crude +1.7 mn barrels

- Distillates -0.15 mn bbls

- Gasoline +2.5 mn

This data point is from a privately-conducted survey by the American Petroleum Institute (API).

- It's a survey of oil storage facilities and companies

- The official report is due Wednesday morning US time.

The two reports are quite different.

The official government data comes from the US Energy Information Administration (EIA)

- Its based on data from the Department of Energy and other government agencies

- Whereas information on total crude oil storage levels and variations from the previous week's levels are both provided by the API report, the EIA report also provides statistics on inputs and outputs from refineries, as well as other significant indicators of the status of the oil market, and storage levels for various grades of crude oil, such as light, medium, and heavy.

- the EIA report is held to be more accurate and comprehensive than the survey from the API

---

Crude prices ended little changed Wednesday (Europe/US time) after a volatile session, with trade dominated more by political headlines than by fundamental supply-demand signals. Prices initially softened in overnight dealings before edging higher through the European morning, despite the absence of a clear catalyst. Market participants instead remained focused on US President Donald Trump’s high-profile appearances in Davos, which helped drive intraday swings across broader risk assets.

Geopolitical rhetoric may have offered limited underlying support. US media outlet NewsNation reported comments from Trump warning that Iran would be “wiped off the face of the Earth” should it attempt an assassination against him, a remark that likely added a modest geopolitical risk premium. That support faded later in the session, however, as crude came under mild pressure following reports that India’s Reliance Industries is set to resume purchases of Russian oil in February after a one-month pause, easing concerns around near-term supply availability.

Energy markets showed little immediate reaction during Trump’s formal address in Davos. Instead, sentiment shifted more clearly toward a risk-on tone after Trump said he would not use force against NATO in discussions around a potential Greenland acquisition. Risk appetite improved further after he cancelled planned February 1 tariffs on European nations following what he described as a constructive meeting with NATO Secretary General Mark Rutte.