FUNDAMENTAL OVERVIEW

Oil prices plunged yesterday at the open following a couple of positive developments over the weekend. In fact, a top Iranian security official said that a structure for negotiations with the US was being set up and Trump confirmed later that Iran was seriously talking to US.

Moreover, an Iranian official stated that media reports of plans for revolutionary guards to hold military exercise in the Strait of Hormuz were wrong. These events eased the geopolitical risk premium and weighed on oil prices. Yesterday, it was announced that US and Iran will hold talks in Istanbul on Friday.

Meanwhile, OPEC+ held output steady as expected over the weekend which is a good thing for oil prices in the bigger picture as an improvement in demand without more output hikes should support the market.

As mentioned last week, it’s not just the US-Iran tensions supporting the oil market, but there’s also the demand part. Yesterday’s US ISM Manufacturing PMI beat expectations by a big margin and the new orders index jumped to the best levels since 2022. Unless we get more output hikes from OPEC+ or the market starts to bet on Fed’s rate hikes, oil prices will likely remain supported.

CRUDE OIL TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that crude oil eventually reached the 66.00 handle and pulled back as the sellers stepped in to target new lows. The break below the 62.37 level saw more sellers piling in to extend the drop into the 58.80 support. The buyers, on the other hand, will either step in around the 58.80 support or wait for a break above the 62.37 level again to position for a rally into new highs.

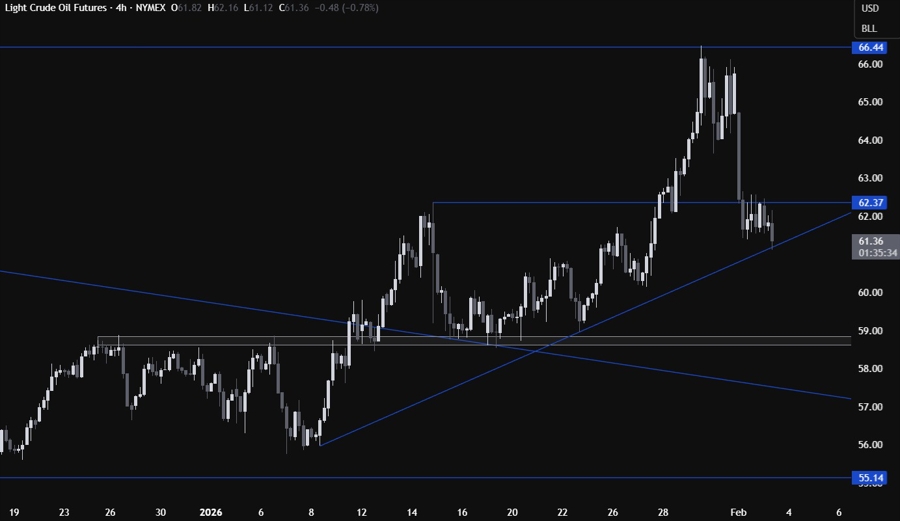

CRUDE OIL TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see that we have a trendline defining the bullish momentum. The buyers will likely lean on the trendline with a defined risk below it to position for a rally into new highs. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 58.80 support next.

CRUDE OIL TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, we can see more clearly the recent price action with the consolidation between the 62.37 level and the trendline. The buyers will look for a break above the 62.37 level to increase the bullish bets into new highs, while the sellers will look for a break below the trendline to extend the drop into new lows. The red lines define the average daily range for today.

UPCOMING CATALYSTS

Tomorrow the US ADP and the US ISM Services PMI. On Thursday, we get the US Jobless Claims figures. On Friday, we conclude the week with the University of Michigan Consumer Sentiment data.