Summary:

ANZ world commodity index down 2.1% m/m in December

Dairy prices slide 5.3%; butter plunges 16.9%

Meat and wool prices hit record for fourth month

Strong NZD drags local currency index lower

Commodity mix softens as NZ recovery begins

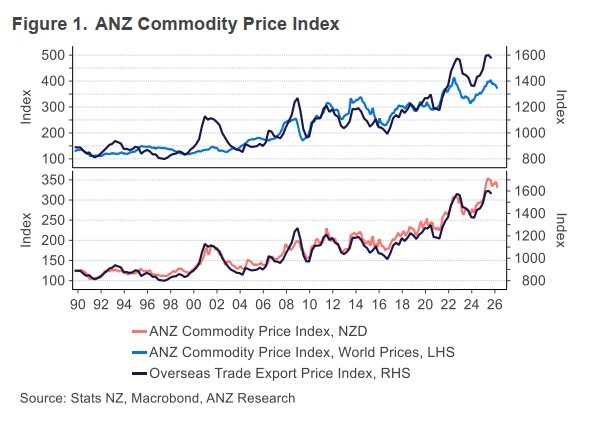

New Zealand’s commodity price pulse weakened further in December, with falling dairy prices again outweighing strength in meat and wool, according to the latest ANZ commodity price data.

The ANZ World Commodity Price Index fell 2.1% month on month in December, driven by a 5.3% m/m decline in dairy prices. ANZ said global dairy markets continue to face heavy pressure from strong milk production growth across most major exporting countries, with butter prices experiencing the sharpest adjustment. Butter prices slumped 16.9% m/m, underscoring the scale of oversupply in that segment.

In contrast, the meat and wool world price index rose 1.2% m/m, extending gains for a fourth consecutive month and reaching a fresh record high. Tight supply conditions in the U.S. beef market have been the dominant driver, while lamb and wool prices have also benefited from supportive demand and constrained availability. Despite the strength in meat and fibre, the broader world price index has rolled over since peaking in May and is now 2.4% lower year on year across 2025.

The picture was more challenging in local currency terms. The NZD Commodity Price Index fell 3.9% m/m in December, as a firmer New Zealand dollar amplified the decline in global prices when converted into NZD. While the NZD strengthened late in the year, ANZ noted that the currency weakened overall through 2025, helping local prices outperform global benchmarks over a longer horizon. As a result, the NZD index is down 1.5% y/y, a smaller decline than the 2.4% y/y fall in the world price index.

The divergence across commodity groups comes as New Zealand’s domestic economy shows early signs of recovery. Recent business surveys point to improving confidence, firmer hiring and stabilising activity as lower interest rates begin to flow through. While ongoing dairy weakness remains a headwind for rural incomes, resilience in meat and wool prices, combined with a broader economic lift, should help cushion the impact on growth into early 2026.