Summary:

Morgan Stanley forecasts gold at $4,800/oz by Q4 2026

Falling rates and Fed leadership change seen as key drivers

Central-bank and fund buying expected to remain strong

Geopolitical risk adds to gold’s safe-haven appeal

Silver outlook supported by supply deficits and China export controls

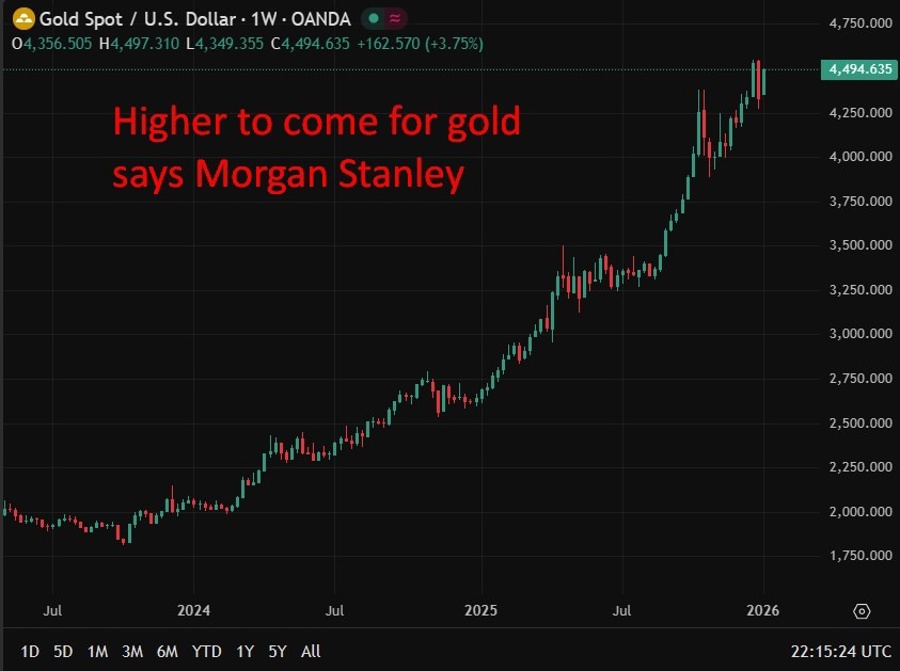

Gold could extend its historic rally well into 2026, with Morgan Stanley forecasting prices to reach $4,800 per ounce by the fourth quarter of 2026, according to a research note dated January 5. The bank expects a powerful combination of monetary, institutional and geopolitical forces to underpin further gains following bullion’s exceptional performance last year.

The forecast builds on expectations of a sustained decline in global interest rates, which would reduce the opportunity cost of holding non-yielding assets such as gold. Morgan Stanley also highlighted the prospect of a leadership change at the Federal Reserve, which it believes could accelerate policy easing and reinforce a softer US dollar backdrop, historically a favourable environment for precious metals.

Geopolitical risk remains an additional tailwind. Morgan Stanley noted that recent events in Venezuela could prompt renewed safe-haven flows into gold, although it did not cite these developments as a core driver of its $4,800 forecast.

The bank also struck a constructive tone on silver, arguing that 2025 likely marked the peak of the market’s structural supply deficit. China’s new export licence requirements, which came into effect at the start of this year, were flagged as a fresh upside risk. Silver surged 147% in 2025, its strongest annual gain on record, supported by robust industrial demand and investor inflows amid tight physical supply.

Gold has already delivered an extraordinary run. Spot prices reached a record high December 26 and bullion finished 2025 up 64%, marking its strongest annual performance since 1979. The bank argues that this momentum is unlikely to fade quickly, given persistent demand from central banks and institutional funds seeking diversification away from traditional reserve assets.