The long-term copper trade is one I've been banging the drum on since at least 2022 and as you look at the longer-term supply gap, this is the year when it really starts to open up and that will be especially true with the massive Grasburg mine mostly curtailed due to last year's tragic mudslide.

On Friday, Union #2 at Capstone Copper's Mantoverde walked off the job on a strike after mediation failed. The mine is running at ~30% capacity as the strike involves roughly half the workforce.

While Mantoverde isn't a behemoth on the scale of Escondida or Grasberg, headline risk is headline risk. In a market that is already hypersensitive to supply-side shocks (thanks to the massive Indonesian outages), losing any fresh tonnage adds fuel to the bullish fire. Reports cite expected production of 29–32k tons for the affected period/year, though the recent sulphide expansion was designed to push total longer-term output significantly higher and that could slow depending on the length of the strike.

That compares to the approx 270K tons forecast to be offline at Grasberg all year but it's still missing marginal supply in a tight market. As for Grasburg, the forecast is still for a gradual return starting in Q2.

Notably, the strike is in the Atacama region of Chile and that is adjacent to the Antofagasta region, which is the global heavyweight of copper production, including the world's largest mines. Labor dissatisfaction could highlight a broader push for higher wages and more disruptions. This year is scheduled to be a bit of a nightmare with give separate union contracts set to expire at Chile's state-run Codelco, with part of the demands around safety (and slower production). There are also currently difficult negotiations going on at Centinela while Anglo American's Los Bronces faces tough negotiations later this year.

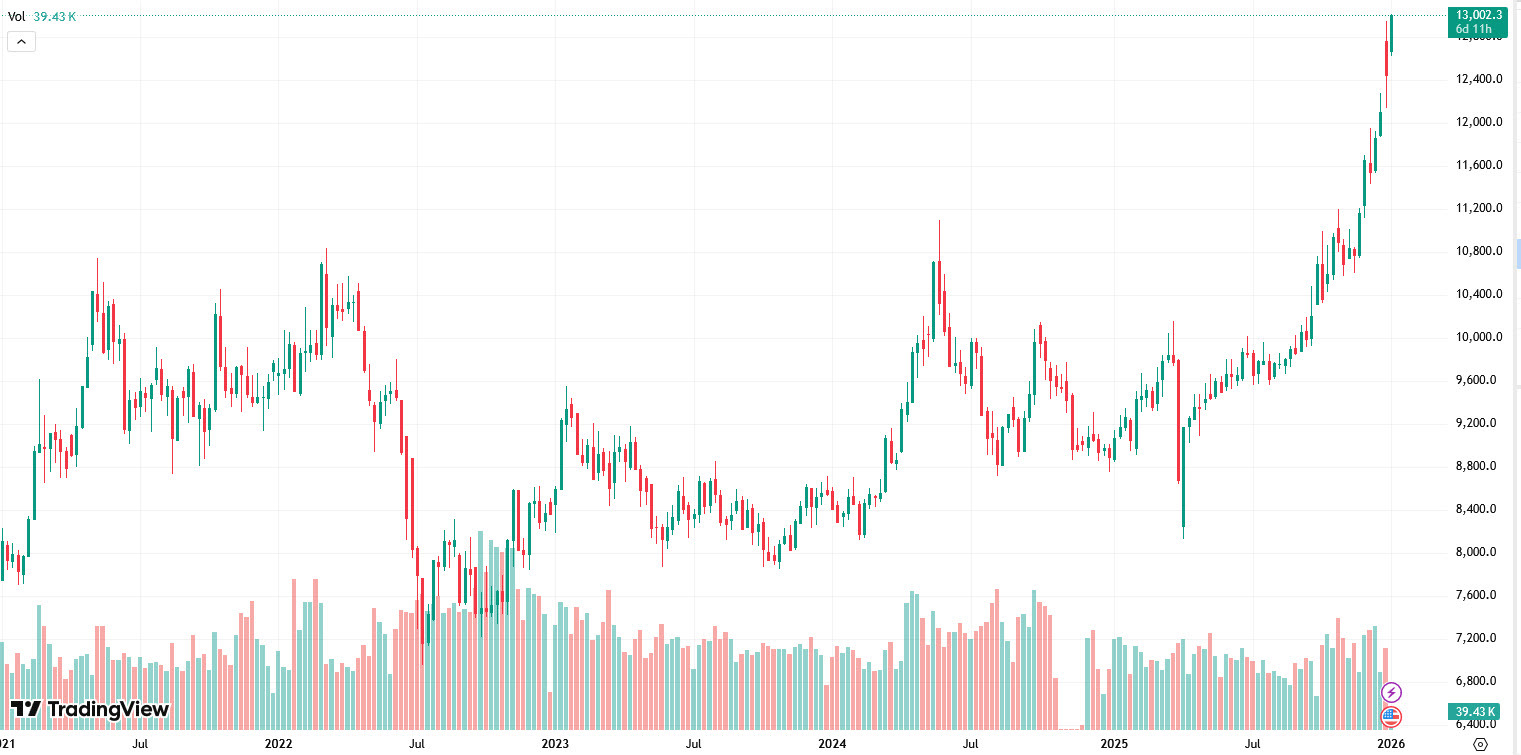

In terms of the technicals, there is nothing standing in the way for further gains. The measured target from the 2022-2025 range is upwards of $16,000.