Thankfully, there's no triple-levered silver ETF, or at least one with any trading volume. With silver down 33% today, that would be an extinction-level event.

We saw something similar in the VIX ETF implosion a few years ago as it was liquidated. This time, there's only a twice-levered ETF to worry about. That's the AGQ product from ProShares.

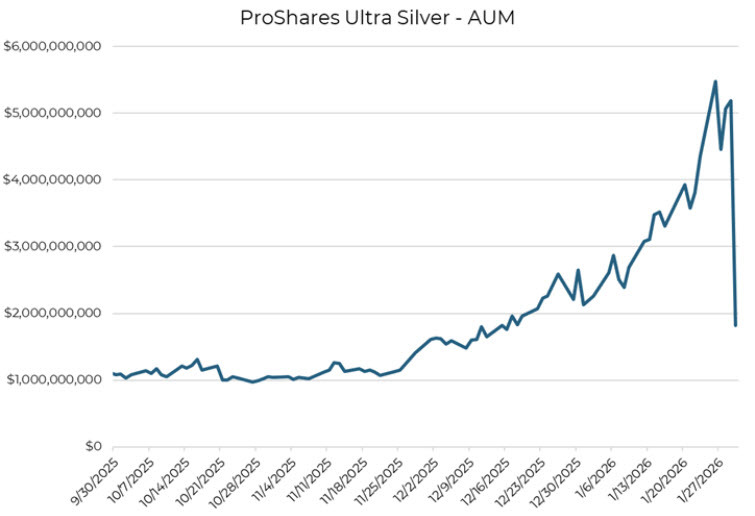

Going into the day, it held about $5 billion in assets tied to silver and -- needless to say -- it's going to be much less tomorrow. It's trading down 66%, which should wipe out about $3 billion of that.

This chart is actually telling in hindsight as it shows a diminishing AUM this week, even as silver made new highs. That was a red flag that retail enthusiasm was waning and now here we are.'

At the moment, it looks like this ETF is behaving as it's supposed to but when markets move 33%, bad things tend to happen so it's worth keeping an eye on the headlines after the close. Whether it's in this ETF or in the derivatives market, there are likely to be some bodies piled up somewhere or some margin calls unmet.

When that happens, there is often even more forced liquidation and further pain. We also haven't seen how these moves will affect foreign markets where margin lines were certainly be ringing over the weekend.

It's an ugly picture all around and so far the indications are that the market is functioning, but whenever a market has its worst day ever -- particularly one as big as silver -- there are some real risks in market plumbing.