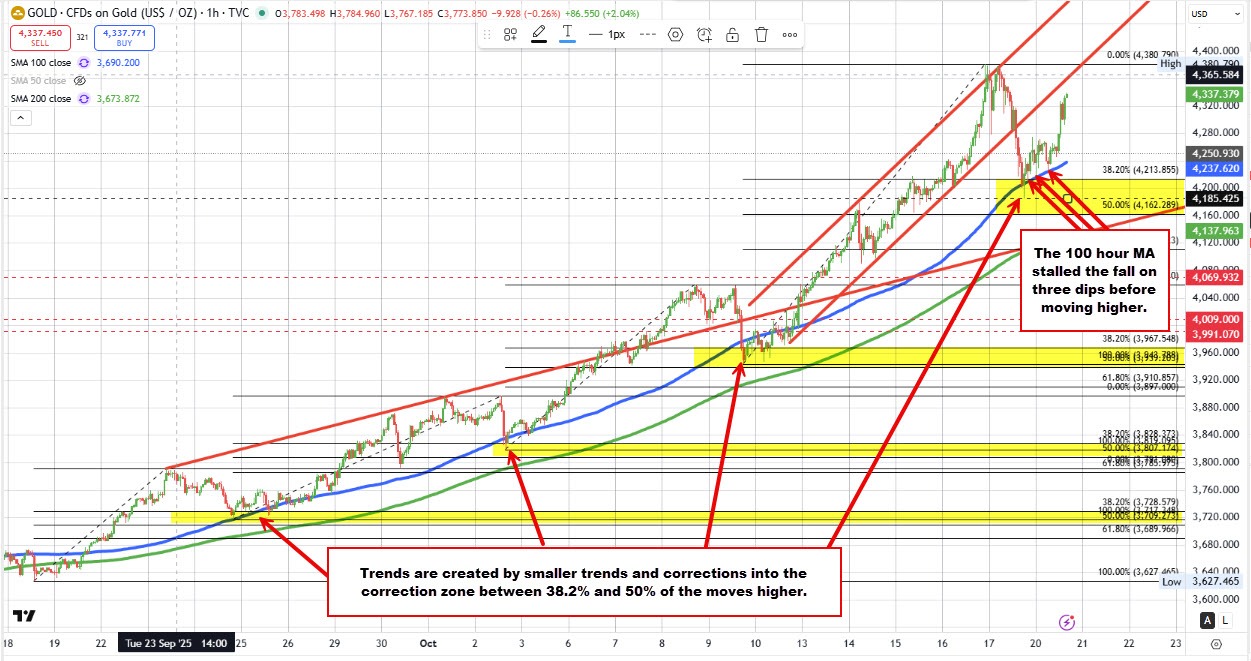

Following a sharp period of profit-taking on Friday, the price of gold found robust buying interest within a critical Fibonacci correction zone. This key support area, defined by the 38.2% to 50% retracement of the most recent upward trend, spans $4162.28 to $4213.85. The low reached on Friday was $4185.42, validating the significance of this support zone before the price pivoted higher.

The subsequent rebound propelled the price back above the rising 100-Hour Moving Average (HMA). This moving average quickly transitioned into a reliable support level, successfully tested three times on Friday and again early today.

This strong defensive action provided buyers with the conviction to initiate a renewed push. Over the last eight hours of trading, the underlying bullish trend has strongly reasserted itself, driving the price to a high of $4334.78, marking an increase of over $80 on the day.

Given the sellers' consistent failure to capitalize on Friday's consolidation, buyers remain in firm control. Further monitoring of the current support levels, including the 100-HMA, is crucial for sellers attempting to reclaim short-term control.