Fundamental Overview

Gold eventually erased almost the entire weekly gain as the short squeeze came to an end. Fundamentally, nothing has changed although the probabilities for a December cut fell to just 40% in the final part of last week.

The market participants continue to wait for the key US data ahead of the December FOMC meeting. Strong US data, especially on the labour market side, should keep weighing on gold as it would keep the market speculating on rate cuts pause. Conversely, weak data is likely to support the precious metal as it would give the Fed more reasons to keep cutting rates.

In the bigger picture, gold should remain in an uptrend as real yields will likely continue to fall amid the Fed’s dovish reaction function. But in the short term, a further hawkish repricing in interest rate expectations should keep weighing on the market.

Gold Technical Analysis – Daily Timeframe

On the daily chart, we can see that gold couldn’t sustain the breakout above the 4,155 level and eventually erased almost all the weekly gains. From a risk management perspective, the buyers will have a much better risk to reward setup around the major trendline to position for a rally into a new all-time high. The sellers, on the other hand, will want to see the price breaking below the major trendline to extend the drop into the 3,312 level next.

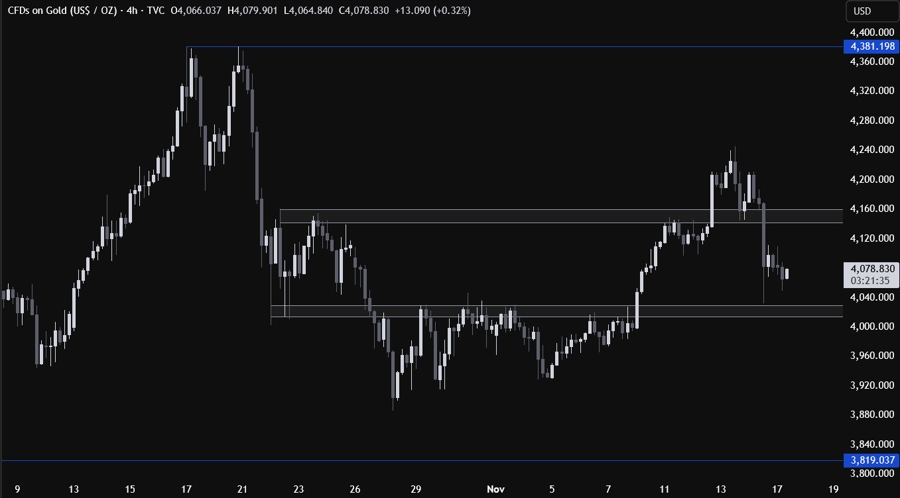

Gold Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we have a strong support zone around the 4,020 level. If the price gets there, we can expect the buyers to step in with a defined risk below the support to position for a rally into a new all-time high. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the major trendline.

Gold Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that we have a minor downward trendline defining the bearish momentum on this timeframe. We can expect the sellers to lean on the trendline and the 4,155 resistance to keep pushing into new lows, while the buyers will look for upside breakouts to pile in for new highs. The red lines define the average daily range for today.

Upcoming Catalysts

Tomorrow we get the weekly US ADP jobs data. On Wednesday, we have the FOMC meeting minutes. On Thursday, we get the September NFP report and maybe the US Jobless Claims data. On Friday, we conclude the week with the US Flash PMIs.