Gold was slammed lower in an instant for unclear reasons.

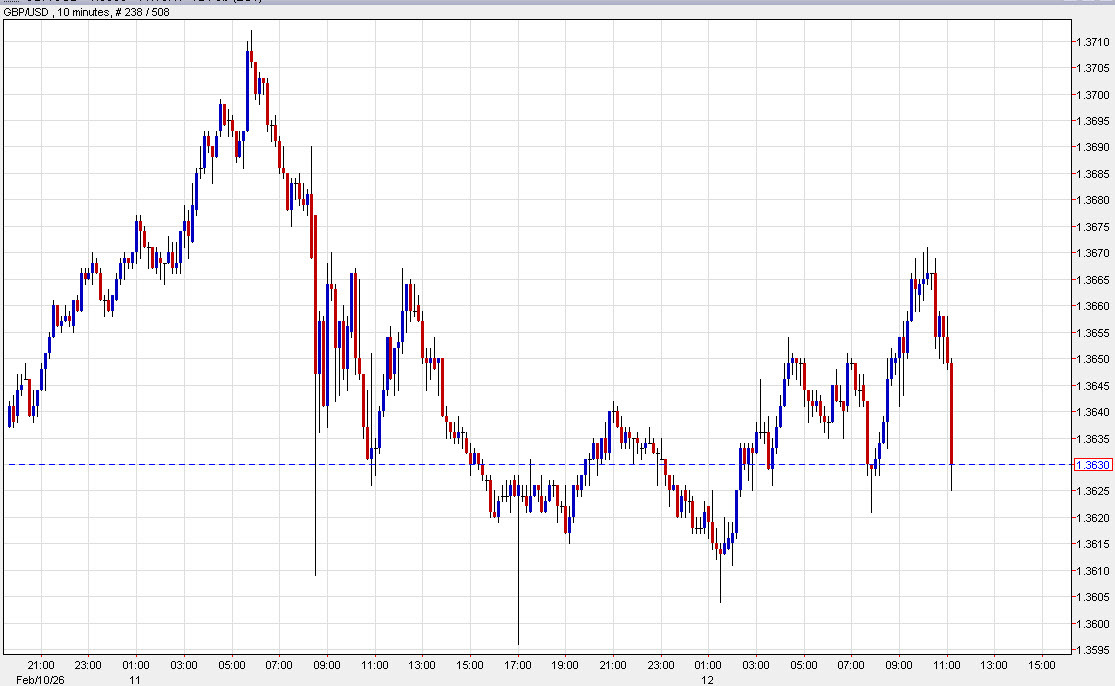

The move has come with some broad US dollar bids across the board. Cable underscores the move as it's fallen back to flat on the day.

The drop in gold and rise in the dollar could have been triggered by broader risk aversion. US stocks have turned deeply negative after opening close to flat. The S&P 500 is down 67 points, or 1.0%. THe Nasdaq is down 1.5% as software stocks are beaten up.

Logistics stocks are also under some pressure today on AI disruption. That came after Algorhythm Holdings (RIME), announced its SemiCab platform. It's claims it's enabling its customers' internal operations to scale freight volumes by 300-400% without an increase in headcount.

The drop in gold is also sparking speculation that the CPI report was leaked. A decline like this could come on a hot report but I'm skeptical that's the case.

Whatever the driver of this move, it adds to the feeling that 'nothing is safe'. I think the trigger on that was Microsoft shares falling 12% in a day. Since then, we've seen rolling fears of disruption.

Software continues to be hit but logistics and transports are getting hit today.

It's possible that someone holding a software position was forced to liquidate a gold position.