Gold is trading just under US$4,210/oz on Friday morning Asia time, with traders turning cautious ahead of a cluster of delayed U.S. data and the Federal Reserve’s meeting next week, December 9 and 10. Spot prices slipped around 0.5% overnight to roughly US$4,180, before grinding back higher.

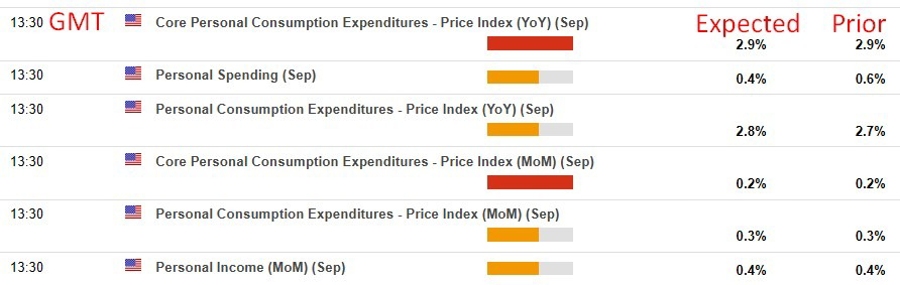

The immediate focus is on today’s U.S. Personal Income and Outlays report, which will finally deliver the September PCE and core PCE inflation readings after delays linked to the government shutdown. The release is scheduled for Friday 5 December, 1330 GMT/0830 US Eastern time, and is expected to show annual core PCE running around 2.9%.

Further out, markets are bracing for

- The Federal Reserve Federal Open Market Committee (FOMC) meeting December 9 and 10 (a 25bp rate cut is widely expected)

- The rescheduled November Employment Situation report, now due 16 December U.S. time, after being pushed back from its original 5 December slot. That print will give the first clean read on the labour market since the shutdown.

- On the inflation side, the next CPI release is pencilled in for 18 December 2025, will help shape expectations for the pace of rate cuts into 2026.

For now, gold remains tightly tethered to U.S. real yields and the dollar: any downside surprise in today’s PCE or the upcoming CPI/ payrolls data that drags yields lower would likely underpin bullion. But with positioning already long after 2025’s big move, a hawkish surprise or stronger jobs print could trigger a bout of profit-taking.