Gold bulls have been waiting a lifetime for a market like this.

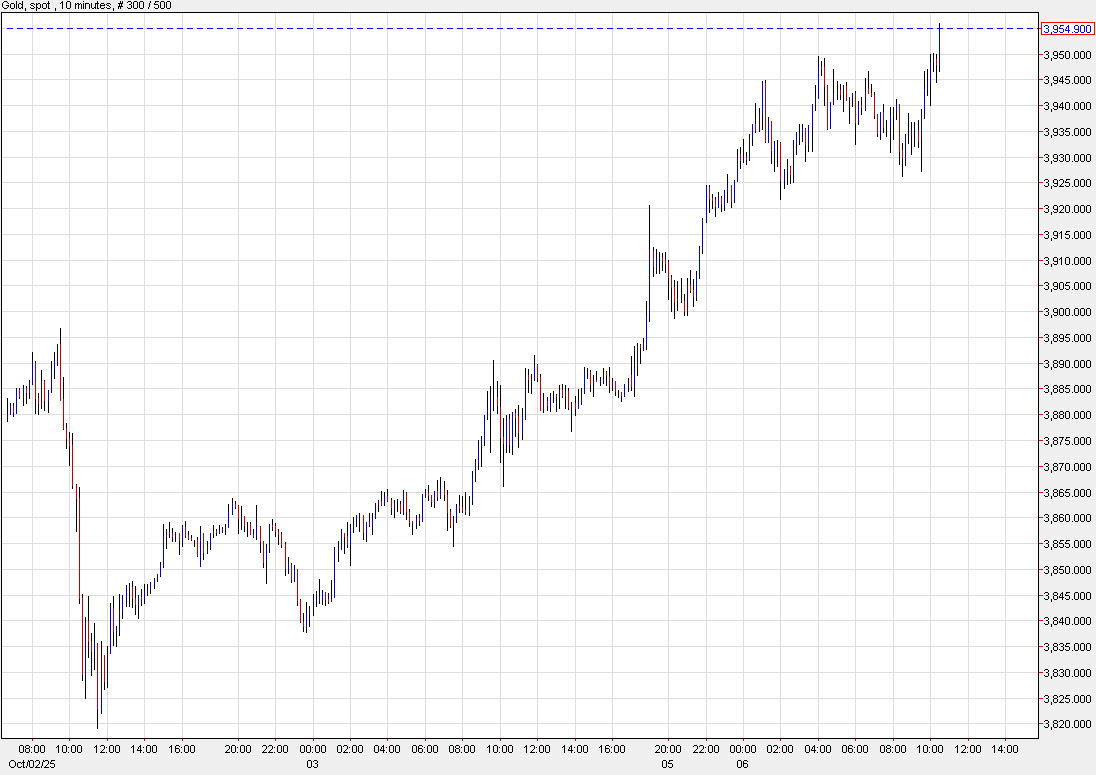

It's been an astonishing run to $3950 from $3350 in just six weeks. The pieces were long in place with recklace fiscal spending and a breakdown in the global order but the final triggers were:

- Big US non-farm payrolls revisions, leading to pricing for a dovish Fed

- Trump firing the head of the BLS and attempting to fire Lisa Cook

It can basically be summed up as: We're going to run it hot, on both the fiscal and monetary side. Combine that with US isolationism and unpredictable comments about US military power and the appetite for central banks and investors to hold US dollars has crumbled. Instead, the world is turning to gold.

Today gold is up another $67 to as high as $3956. It's the first time above $3950 and all eyes are now on $4000, which will assuredly trigger some profit taking.

Both the commodity and commodity producers have surged in the past six weeks and investors are looking for value.

Looking through some TD decks at the moment, miners aren't pricing cheap, which is what you'd usually expect in a massive commdity move (though those are usually cyclically drive).

Here are FCF yields for the top gold producers on 2026 numbers at spot (albeit Friday's spot):

- AEM 6.1%

- B 8.1%

- KGC 8.6%

- NEM 7.0%

Even going down to intermediate and junior producers, it's a struggle to find free-cash-flow yields in the teens, though some are certainly in mine-development cycles. There are some better EV/EBITDA and P/NAV numbers but those are problematic at the best of times. Leverage is low in the industry as it's been capital constrained for some time. In general, M&A kicks off at this point so takeover targets are a good place to start but one is Lundin Gold, which has a prolific mine in Ecuador but it's already had a sensational run.

All that to say there isn't a lot of low-hanging fruit here, though all the valuations certainly look much better if you're betting on $5000 gold.