Many traders and investors are looking at Gold and Silver Prices Today

The precious metals market has entered a period of historic volatility and "hysteria," with silver leading a parabolic charge that has seen prices double in just over a month. According to Adam Button, silver’s recent surge to a fresh all-time high of $112 represents one of the all-time great days in the silver market, a "meme"-like move driven by retail mania and physical deficits that echoes the infamous Hunt Brothers squeeze. This momentum was further analyzed by Justin Low, who noted that despite a heavy bout of profit-taking, silver is back on the run again after surging another 9% in a single day. Low emphasizes that while currency debasement and supply tightness underpin the rally, the rapid 57% gain this month alone suggests a "hammer" may eventually fall, though dip buyers remain poised to defend the trend.

Gold has also reached unprecedented milestones, though experts remain divided on the sustainability of its current price action. Giuseppe Dellamotta describes the atmosphere as hysteria in the gold market following the metal's breach of the $5,000 mark, suggesting the move is currently fueled more by FOMO (fear of missing out) than immediate fundamentals. He warns that an upcoming Fed chair announcement or strong labor data could trigger a sharp correction from these "unjustified" short-term levels. Conversely, institutional sentiment remains aggressively bullish for the long term; Eamonn Sheridan reports that Morgan Stanley sees gold reaching $5,700 later this year. This outlook, shared by other major banks like Société Générale, is supported by structural shifts including persistent central-bank accumulation and the metal's evolving role as a strategic hedge against global trade fragmentation.

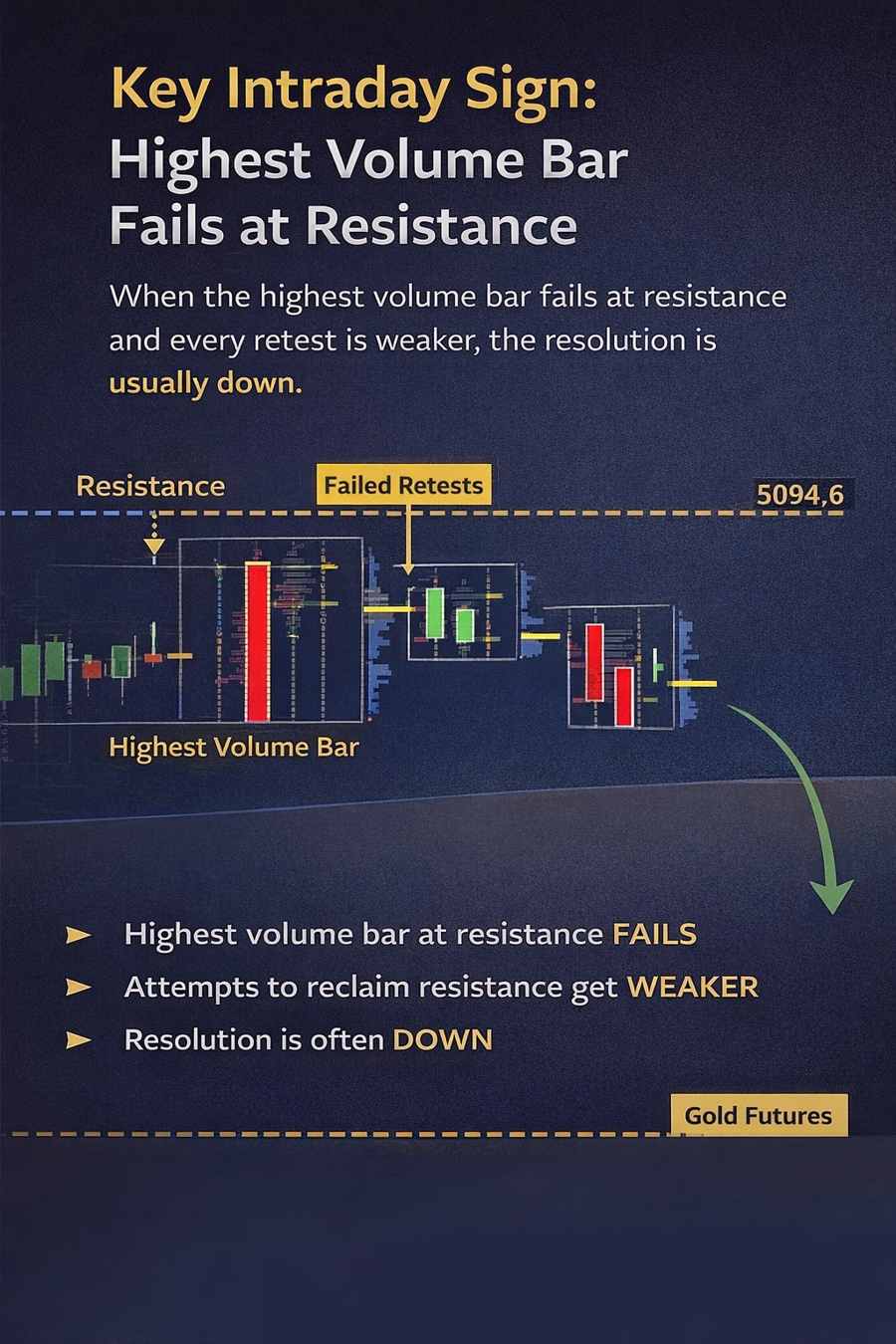

We checked with our orderFlow Intel and prividing this gold futures trader update: failed breakout at value highs hints at downside rotation

Gold futures are sending an important short-term message through price action and order flow after failing to sustain a move above the day’s value area high near $5,094.6.

While markets never offer certainty, the sequence of events at this resistance zone provides useful decision support for traders who focus on how price, volume, and buyer-seller dynamics interact at key levels.

What happened at resistance for Gold futures today and why it matters

Gold attempted multiple times to build acceptance above the value area high. Each attempt was met with selling pressure, and the most important clue came early in the sequence.

The highest volume bar of the session appeared directly at resistance and failed to push price higher. This is a recurring auction principle across markets. When the largest amount of participation occurs at a level and price does not expand, it often signals inventory transfer rather than accumulation.

What followed strengthened that message:

Each subsequent retest of resistance showed lower volume

Delta remained negative across attempts

Buy-side follow-through weakened

Later rallies stalled earlier than prior ones

A common educational takeaway here is worth repeating:

When the highest volume bar fails at resistance and every retest is weaker, the resolution is usually down rather than sideways.

Usually does not mean always, but it does mean probabilities begin to tilt.

From balance to distribution

Initially, price behavior could still be interpreted as rotation or digestion. That ambiguity faded once the market failed to reclaim the prior high-volume node and then produced a decisive downside bar with strong sell dominance.

At that point, the structure shifted from two-sided balance into distribution near the highs, followed by acceptance at lower prices.

This is how many intraday and short-term reversals begin. Not with panic, but with fading quality on upside attempts, declining participation on rallies, and sellers becoming more confident each time price revisits resistance.

Why volume matters more than direction alone

Many traders focus only on whether a bar is green or red. Order flow adds an extra layer by asking a more important question:

Did effort produce result?

In this case:

Effort was high near resistance

Result was poor

Subsequent effort was weaker

Downside effort finally produced progress

That sequence is often an early signal that profit-taking or short-term distribution is underway, especially after extended upside runs.

Broader metals context adds relevance

This behavior in gold is also appearing against a broader metals backdrop.

Yesterday was another strong session across the metals complex, with silver futures reaching a new all-time high near $117. At the time of this update, silver futures are trading around $112.54, down roughly 2.6% from that peak.

After such powerful moves, it is normal for market participants to reassess risk, take partial profits, or reduce exposure. Gold does not trade in isolation, and the recent strength in silver raises a reasonable question for traders:

Are early profit-takers beginning to test the waters in precious metals more broadly?

Order flow does not answer that with certainty, but it can highlight where behavior starts to change, and in gold, that change has appeared first at a well-defined resistance zone.

What gold traders should watch next for today

From here, the focus shifts to how price behaves inside value:

Does gold rotate toward VWAP and stabilize?

Do sellers remain in control on rallies?

Does volume expand on downside moves or contract into support?

As long as price remains below $5,094.6, rallies are more vulnerable to selling pressure. A sustained reclaim of that level with improving buyer activity would be required to challenge the current bearish short-term bias.

A final educational reminder for gold traders

Order flow is not a crystal ball. It does not predict outcomes with 100% accuracy. What it does offer is context.

It helps traders answer questions like:

Who is more aggressive at key levels?

Is participation expanding or drying up?

Are moves being accepted or rejected?

In this case, gold is telling a clear short-term story: upside attempts are losing quality, and sellers have gained control near the highs.

That does not guarantee continued downside, but it tilts the odds and helps traders frame risk with discipline rather than emotion.

Join our free Telegram channel https://t.me/investingLiveStocks where we occassionally dish out trade ideas for gold, too. Always at your own risk and purely for educational purposes only.