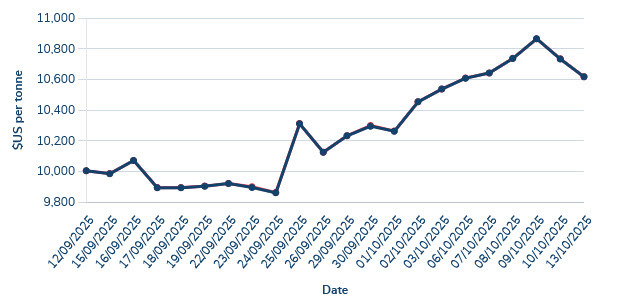

I've been writing for years about the bullish setup in copper and prices hit a record last week.

Bloomberg has an interesting article today about smelter benchmark prices breaking down.

The global copper industry has long relied on a single benchmark for sales of semi-processed ores known as concentrates. Copper smelters receive processing fees called treatment and refining charges, or TC/RCs, to turn concentrates into metal.

These fees — which are deducted from the value of the metal contained in concentrates — are crucial to keep the furnaces running, as they typically account for almost one-third of smelters revenues.

But unprecedented supply disruptions, smelting expansions, as well as strong buying interest from traders, have pushed benchmark TC/RCs to record lows in 2025.

Freeport McMoran said it plans to break away from that benchmark as processing fees collapse and potentially turn negative. That dynamic doesn't really make sense to me but it strange markets, strange things happen.

For all the talk of building out massive amounts of electricity for AI and EVs, there is no plan to get the copper to wire it all.