A surprise in this week's Fed decision was a hawkish dissent from Kansas City Fed President Schmid, who didn't want to hike rates. In his published comments today regarding the dissent, one of the things he highlighted was the tailwind from 'financial conditions'. That's a code phrase from the Fed that mostly means 'the stock market' and what he's saying is that rising stock prices will boost growth, or at least signal that the Fed isn't leaning too hard on the brakes.

An index published by Goldman Sachs shows that broader financial conditions are currently the most accommodative they have been in three-and-a-half years and that they've only been looser twice since 1990 (ex pandemic).

National Bank notes that in other loose periods in 1999 and 2018, the Fed was tightening and now it's doing the opposite.

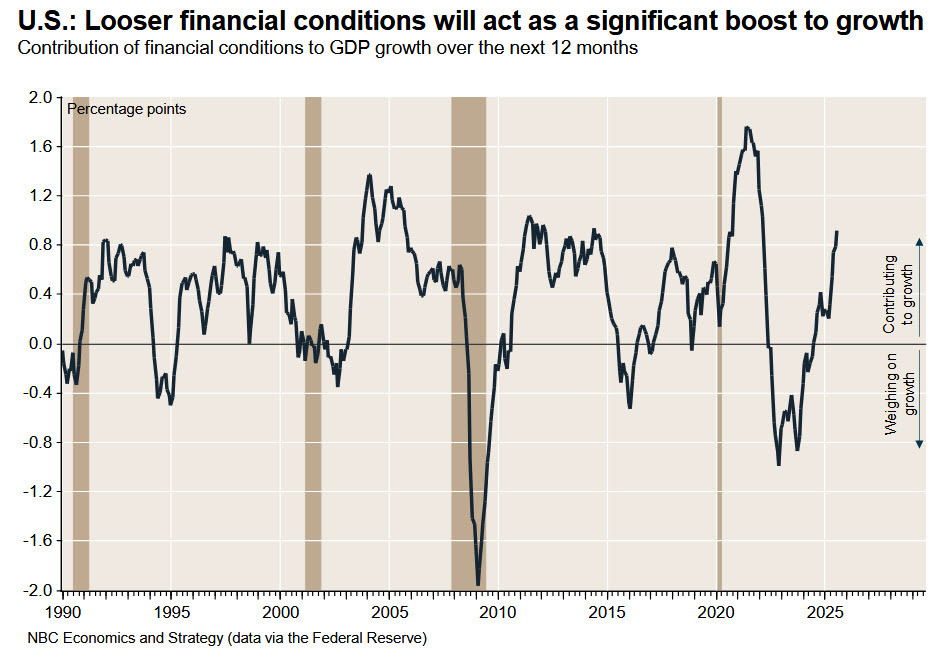

A model developed by the Fed suggests that, at their current level, financial conditions could add as much as 1% to growth over the next twelve months. That's all well and good, but when you add to these figures the anticipated effect of the three other elements covered in recent days (AI investment, the wealth effect, and fiscal policy), there is reason to fear that the economy could overheat in 2026. (Keep in mind, we haven’t even mentioned the supply shock that could be caused by tariffs and the reduction in the labour supply due to stricter immigration policies.) This is certainly a risk that is increasingly on our minds.