The meeting decision today is widely expected to be an uneventful one. So if the ECB plays their cards right, that is precisely what is going to happen. And that can be viewed as a successful outcome in terms of managing market expectations and any reactions for today.

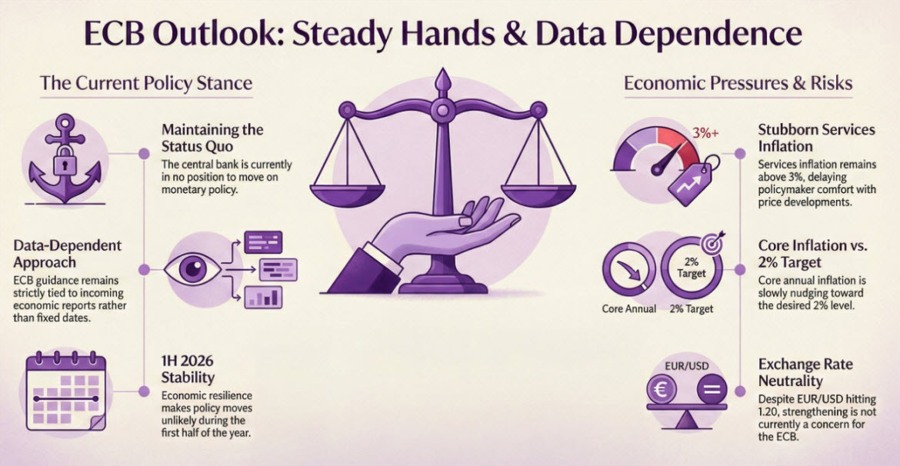

The bottom line is that the central bank is in no position to be making moves on monetary policy currently. Economic growth in the euro area has been resilient and inflation pressures have remained fairly stubborn since the second half of last year. That makes for a tough backdrop to do anything, at least in 1H 2026.

In terms of price developments, core annual inflation is at least continuing to slowly nudge towards the desired 2% level. We can start to see that from the latest consumer price inflation report here. However, policymakers are likely to only feel more comfortable about that if services inflation also shows a more material drop. Currently, that continues to hold above the 3% mark.

Taking that into account, the statement language and forward guidance is expected to be rather unspectacular today. In essence, the ECB will reaffirm that it is still on a data-dependent approach with likely no change whatsoever to their take on inflation developments.

So, what else can we expect from the ECB in this case?

As always, Lagarde's press conference is going to be the more interesting bit. Given the fact that we did see EUR/USD clip the 1.20 mark recently, she will surely face questions on the exchange rate. However, I'd expect her to brush that aside with a neutral response and continue emphasising that the euro strengthening is not a concern for the ECB at this stage.

The key risk factor to watch will be for any potential comments about a change in policy stance if inflation pressures continue to undershoot in the months ahead. The current "goldilocks" situation fits with market pricing and the ECB communication for now, but will Lagarde offer any clues on what could trigger a change?

At this stage, I'm sure they would want to keep the door open to more rate cuts - perhaps in 2H 2026. So, we'll see if Lagarde wants to play it safe or offer up a bit of a teaser to markets today.

I'll be back with commentary from key analysts later in the day.