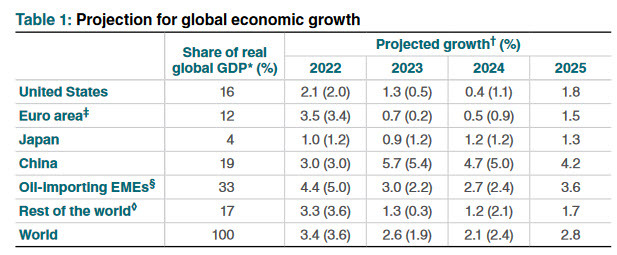

The Bank of Canada released its quarterly Monetary Policy Report today and it includes the latest estimates on domestic and global growth. The general tenor is that 2023 ex-Japan will be stronger while 2024 will be softer before the world accelerates into 2025.

"Global growth is expected to weaken through the second half of 2023 to the first half of 2024, weighed down by restrictive monetary policy in advanced economies," the MPR says.

Overall, global growth was revised up 0.7 pp for 2023 and down 0.3 pp for 2024.

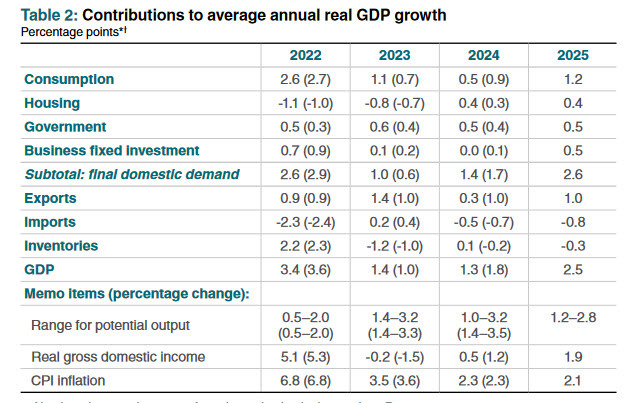

For Canada, the BOC said Growth in consumption spending has been temporarily boosted in 2023 by stronger-than-expected employment and population growth and by the new temporary transfers announced in government budgets. They also warn that export growth surged unexpectedly in the first quarter of 2023, led by the supply chain improvements in the auto sector and the shipping of the abundant 2022 agricultural harvest. They say this strength is temporary, and export growth has been revised down thereafter due to negative revisions to demand for Canadian exports from the United States.

The inflation forecasts are broadly unchanged with the BOC expecting a quick decline to around 3% in the middle of this year followed by a slow grind to 2%.

"By the end of this year, inflation is projected to remain well above central bank targets. Further declines in inflation will largely depend on how quickly growth in services prices slows," the BOC said, highlighting the key area to watch.

A key difference between the Canadian and US economies at the moment is that the US is throttling immigration while Canada is accelerating it to 1 million people per year (in a country of 38 million). So despite strong jobs growth in Canada, labour can loosen more quickly.

Of course, all those people need somewhere to live and that should support Canada's frothy housing market. The BOC says it expects housing will stabilize around the middle of the year with growth in residential investment picking up in H2.