If US equity market movements are anything to go by a downside surprise seems the most likely:

Strong start to the new trading week in the US stock market

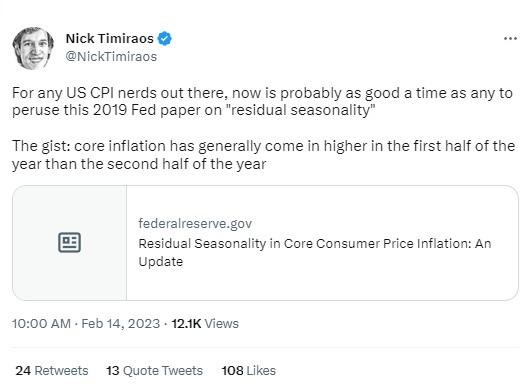

However ... this tweet from the Wall Street Journal's ace Fed reporter:

The paper he is referring to is here:

----

CPI data is due at 8.30am US Eastern time, which is 1330 GMT.

Previews here:

- Goldman Sachs on US Jan. CPI: "potential to interrupt the more relaxed inflation outlook"

- (this one also includes JP Morgan's scenarios for the stock market)

- US CPI report due Tuesday, 14 February 2023 - preview

- Revisions make for a particularly tricky US CPI report

--

Repeating myself from yesterday ....

Background to this is that back in June of 2022 Timiraos dropped the bombshell during the Federal Reserve blackout period:

WSJ Fedwatcher Nick Timiraos is just out with a new report previewing the FOMC.

- "A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week," he writes.

- The report is speculation but it taps into the old-style Fed leaks.

That post, as was Timiraos, was spot-on. Timiraos has thus been crowned the new Hilsenrath (you may remember his role during the Bernanke Fed as a provider of Fed-insider info).