As part of Deutsche Bank's 2024 World Outlook is their projection for the US economy and Federal Reserve response:

- The lag of policy will help trigger a mild US recession in H1 2024 with the upside risks being a continuation of the inflation/labour market progress made in 2023, with the downside being the non-linearity risk mentioned above. We think there will be 175bps of Fed cuts in 2024.

Deutsche Bank forsee two-quarters of negative economic growth in H1 of 2024:

- a "pretty sharp rise" in the unemployment rate to 4.6% by the middle of 2024

- and thus a more aggressive cutting profile starting in mid-year

- economic weakness will ease the pressure on inflation

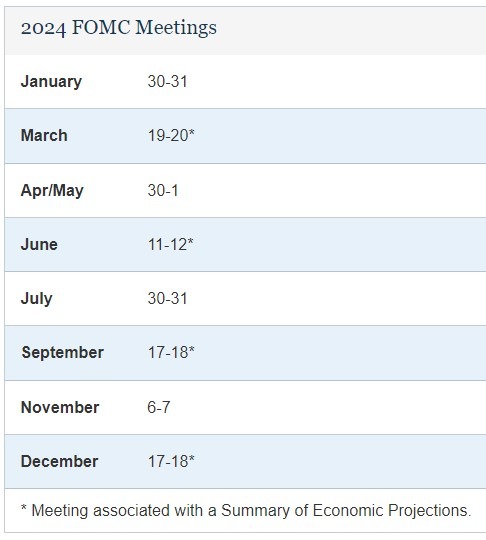

- and thus an initial 50 basis point cut at the June 2024 Federal Open Market Committee (FOMC) meeting & another 125 bps of cuts over the balance of the year

DB forecasts EUR/USD at 1.07 by the end of 2024.