US inflation data is due on Tuesday. While the December Federal Open Market Committee (FOMC) meeting is expected to be an on-hold decision any blowout in headline and/or core above maximum estimates (see below) will spark speculation that the meeting could shift to 'live'.

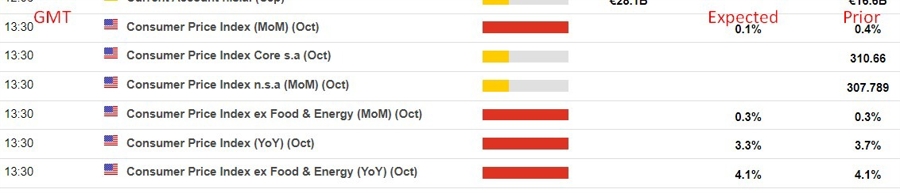

Expectations for the headline rate centre on 0.1% m/m and 3.3% y/y with range:

- m/m 0.0 to 0.3%

- y/y 3.2 to 3.7%

Expectations for the core rate (excluding food and energy) centre on 0.3% m/m and 4.1% y/y with ranges:

- m/m 0.2 to 0.4%

- y/y 4.0 to 4.2%

Preview comments via TD:

- Our forecasts for the October CPI report suggest core inflation gained additional speed for a third month straight: we are projecting an above-consensus 0.36% MoM increase, modestly up from 0.32% in September.

- We also look for a 0.10% gain for the headline, as inflation will benefit from the sharp retreat in energy prices.

- Importantly, the report is likely to show that the core goods segment likely added to inflation, while shelter-price gains probably slowed. Note that our unrounded core CPI inflation forecast could easily turn to a 0.3% rounded gain if some of our key assumptions for October don't come to fruition. Our MoM forecasts imply 3.3%/4.2% YoY for total/core prices.

The data is due at 8.30 am US Eastern time on Tuesday, 14 November 2023.