Justin had the UK January CPI data here overnight:

Comments on the data via Deutsche Bank:

January CPI printed well below expectations

- core CPI easing materially

- What was behind the slowdown in inflation momentum? A combination of easing core goods prices, falling pump prices, and softening non-core services prices (particularly travel and package holidays). Weight changes dragged on CPI too, with 2023 weight changes shaving off a couple of basis points from headline CPI.

- headline CPI came in bang in line with the MPC’s forecast

- services CPI — the key metric the MPC will be looking at — slipped further than the Bank thought

- Core services was broadly stable, once we strip out the more volatile items

- overall core CPI, printed a tenth above the MPC's forecast

And, DB on implications for the Bank of England Monetary Policy Committee

- With regards to monetary policy, we still see a case for one more hike (25bps) before the MPC opt more explicitly for a 'conditional pause'. That said, slowing momentum in both the wage and inflation data will likely make next month's rate decision more finely balanced than markets expect.

----

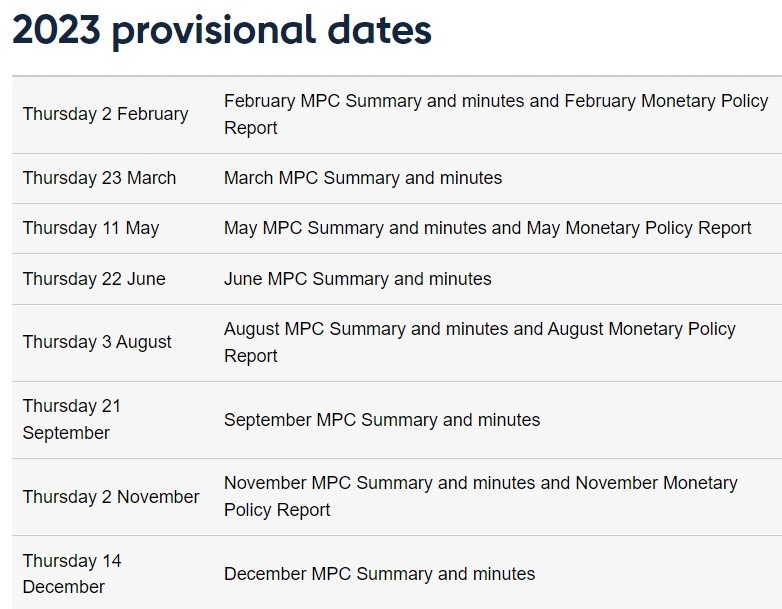

2023 dates for the BoE MPC: