This is a tough environment to trade in and equally tough to set policy in.

Signs of a more-dovish Fed have been slim so far but the door was cracked open yesterday by St Louis Fed President Musalem who highlighted some downside risks to the economy. Otherwise, it's mostly been similar 'wait and see' statements from everyone at the Fed, with a strong emphasis on wanting to see 2% inflation before cutting.

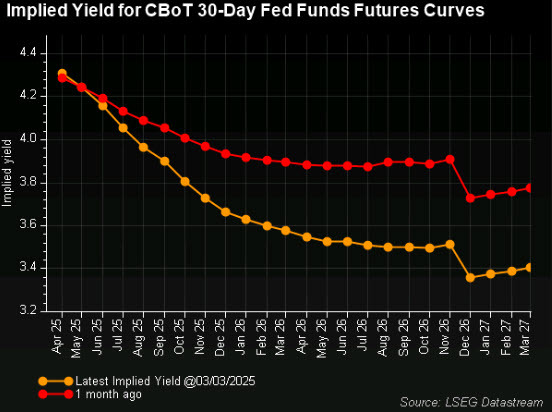

The market isn't waiting for a stronger signals as it prices in 80 bps of easing this year, up from 40 bps just a couple weeks ago.

The upcoming March meeting still shows a very small chance of a cut but the subsequent meeting on May 7 meeting is now above 50%.

Further out the curve, there is about a 50 bps drop in the terminal rate.