The Federal Reserve blackout period is a designated time frame during which Federal Reserve officials are restricted from making public comments about monetary policy. This period is meant to prevent any unintended influence on financial markets ahead of key policy decisions.

Key Features of the Blackout Period:

Timing:

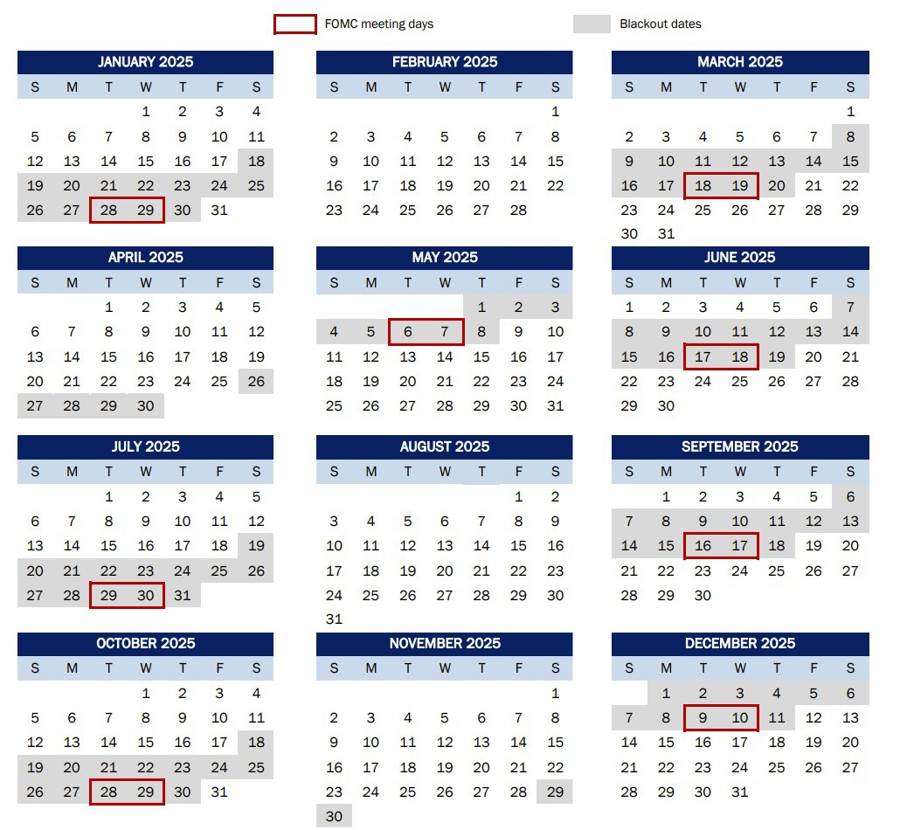

- The blackout period begins on the second Saturday before a Federal Open Market Committee (FOMC) meeting and

- Ends on the Thursday following the meeting (or at midnight Eastern Time if the FOMC meeting is on a Wednesday).

Restrictions:

- No public speeches, interviews, or discussions on monetary policy.

- Officials cannot discuss economic outlooks, interest rates, or related policy decisions.

- Private discussions with market participants are also discouraged.

Purpose:

- Prevents Fed officials from influencing markets through last-minute comments.

- Ensures that policy decisions are based on data and discussion rather than speculation.

- Helps maintain credibility and avoid confusion about upcoming interest rate changes.

Exceptions:

- Routine communications and reports may still be released.

- Officials can discuss non-monetary policy topics, but they typically avoid media engagements entirely.