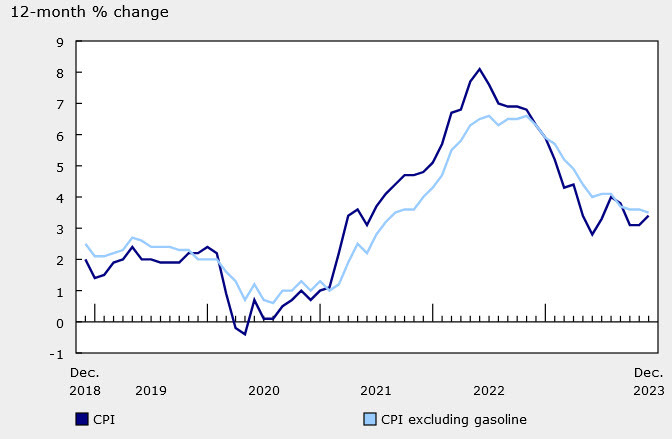

Today's CPI report showed a dip in headline inflation to 3.1% from 3.4% but the Bank of Canada might be troubled by the lack of progress on core CPI.

"What wasn't expected was the lack of progress in the Bank of Canada's preferred core measures of inflation, CPI-trim and CPI-median. CPI-trim accelerated by two ticks to 3.7% and median remained at 3.6%," CIBC writes, noting that the prior was also revised higher.

"The Bank of Canada will still need to see more progress before considering rate cuts, and we continue to look for the first cut in June

Digging deeper, they looked at the factors behind high inflation.

Airfares were a big one as they rose 7.7% m/m on strong demand for travel during the holiday season. Car prices also jumped, as 2024 models became available, but they noted that will likely be a one-off impact.

"Food price inflation picked up, with grocery store prices up 0.5% SA m/m, and restaurant prices up by 0.6% SA m/m. Strong inflation in food (+5.0% y/y) is likely keeping inflation expectations elevated, as consumer expectations are tied closely to things that are purchased on a regular basis," CIBC writes.

They see no reason to adjust a call for BOC cuts and that goes against the market, which is pricing a 90% chance of an April cut.

"Headline inflation likely won't fall into the Bank of Canada's target range for a few months, but the key to our call for the Bank to start cutting interest rates in June will be further progress in core measures, particularly excluding shelter costs, which are being impacted directly by the Bank of Canada's previous interest rate hikes. Sluggish economic growth and the deterioration in the labour market should leave underlying core measures on a decelerating track ahead."