Yesterday the Fed funds futures market was pricing in a year-end rate as low as 3.85% on fears of a spreading banking crisis.Today, there have been no bank failures and that's prompted a quick rethink.

The year-end rate is now at 4.46%, which is only slightly below the current rate of 4.50-4.75%. As for the upcoming meeting, the consensus is now at 80% for a 25 bps hike and that's the path of least resistance. The data wasn't too hot and Powell already pushed back against 50 bps.

Retail sales are still to come this week but it's tough to imagine that will be a game changer.

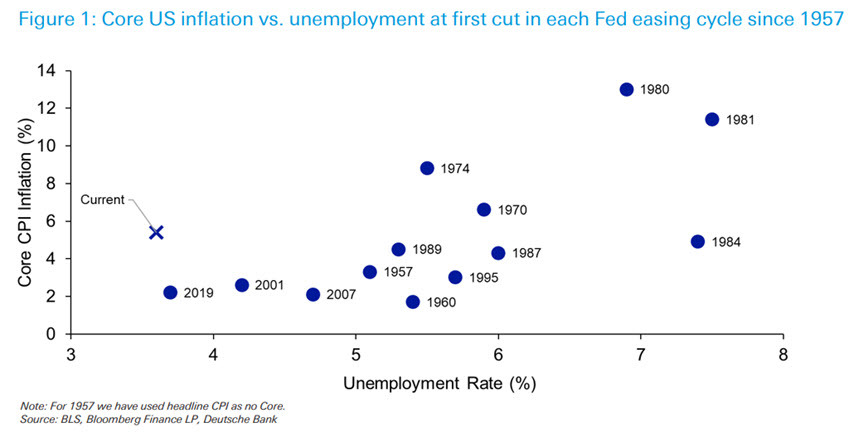

Deutsche Bank today notes that there's never been a rate cut when the unemployment rate is this low.

"This chart is more to suggest that we probably need firm evidence that unemployment has turned or is quite clearly about to, or that inflation is close to target, before we can talk rate cuts. Clearly market turmoil in the next 5-6 days before the FOMC could persuade the Fed that this is about to happen but the chart shows the macro dilemma the Fed is in," Deutsche Bank's Jim Reid writes.

Assuming a vanilla 25 bps hike, the main risk for this month is the Fed dot plot. But so long as Powell indicates that there's a reaction function to bank stress, the market can take a 5.5% dot with a grain of salt.

What I think is coming is a market that's going to quickly forget this whole episode. Are banks truly going to materially change lending after this? Some might and there will be more conservatism on the margins but if that comes with a lower terminal rate, I think it's ultimately more inflationary but it's tough to have any confidence in that call.

How I think it ultimately shakes out is that it doesn't derail the Fed or results in a policy mistake but it lengthens the timeline to get inflation back to target to end-2024 or even longer. That's not that big of a deal compared to something like mid-2024.

What I worry about is that we get another round of commodity-led inflation because we've been led into a bit of a false sense of security due to good weather. Much of that will depend on China though and whether that economy heats up this year or next.