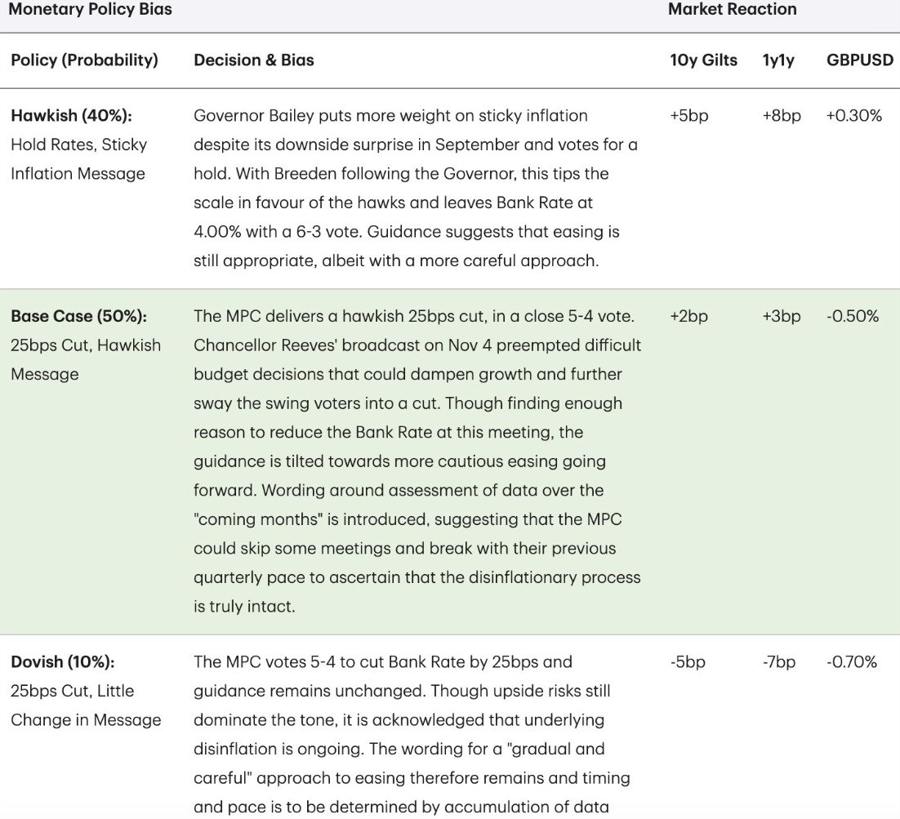

TD Securities expects the Bank of England to deliver a finely balanced 25-basis-point rate cut at its meeting today, with the vote likely to split 5–4. Analysts at the firm said policymakers will probably justify the move by citing persistently elevated inflation, signalling a more cautious approach to further easing than previously anticipated.

- TD noted that incoming data in the months ahead will be critical in determining the timing of any additional cuts.

On the currency front, it warned that sterling is likely to stay under pressure regardless of whether the central bank moves this time or delays action until later in the year. The firm sees further upside for the euro against the pound and continued downside risks for GBP/USD.

---

Cheat sheet: