KEY POINTS

- The SNB is expected to keep interest rates steady at 0.00%

- FX communication to remain unchanged

- To downplay the recent miss in inflation data

- To upgrade future outlook due to lower US tariffs and less uncertainty

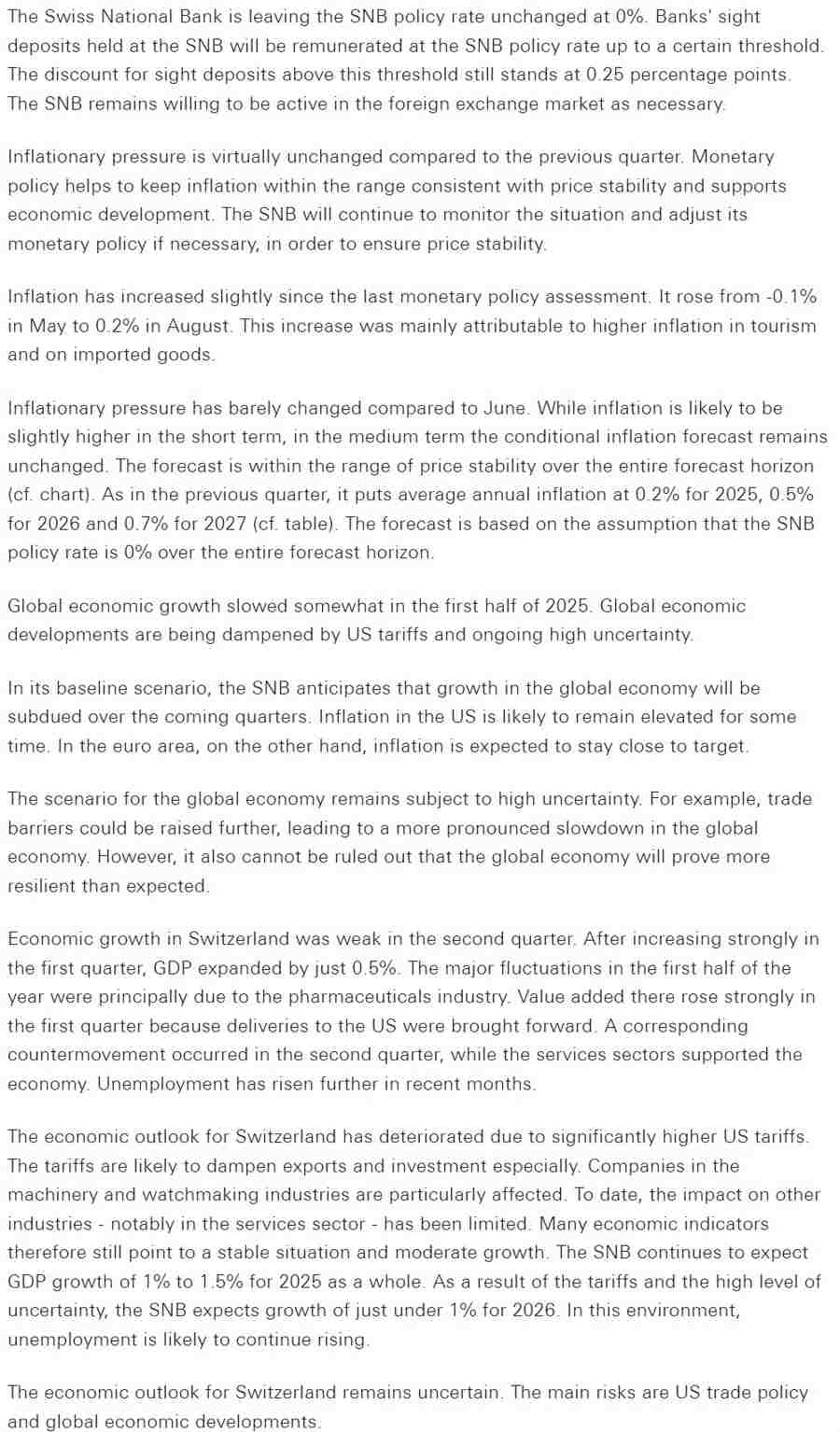

The Swiss National Bank (SNB) is expected to keep interest rates steady at 0.00%. The recent inflation data missed the SNB's forecast prompting the market to increase a little bit the probabilities for negative rates.

Those bets were pared following the trade deal with the US in which the tariffs on Swiss goods were lowered to 15% from 39% effective retroactively from November 14. Moreover, SNB's members have continuously donwplayed the weaker inflation readings and reiterated that the bar for negative rates was very high.

The central bank is likely to keep most things unchanged with maybe a slight downgrade to 2026 inflation forecast and upgrade to growth. They should also highlight the lower US tariffs which should have a positive effect on the economy going forward.

STATEMENT

There shouldn't be changes in terms of key policy messages. The SNB should keep the phrases "willing to be active in the foreign exchange market as necessary", "will continue to monitor the situation and adjust its monetary policy as necessary" and "forecast is within the range of price stability over the entire forecast horizon".

The central bank is likely to downplay the miss in inflation in the recent months and slightly downgrade the inflation forecast for 2026. It might also upgrade growth forecast in light of the recent US tariff deal. In fact, the most notable changes should be on the trade side.

PRESS CONFERENCE

SNB's Chairman Schlegel should reiterate that they expect inflation to pick up in the next months and that the bar for negative interest rates remains very high. He's should highlight how the lower US tariffs are expected to have a positive effect on the Swiss economy in the next quarters.

MARKET PRICING

- December cut: 0% probability

- Total 2026 tightening: 5 bps

MARKET REACTION

We might see some short-term CHF strength on the more positive economic outlook, but in the bigger picture it shouldn't change much as the SNB will likely remain on hold for a long time. Therefore, the Swiss Franc will remain mostly a risk-on/off play for now with monetary policy divergence likely to play a bigger role in 2026 as some central banks could deliver rate hikes.