The Bank of Canada is widely expected to leave rates unchanged today at 10 am ET after signalling a pause in the previous statement. Last month, the market briefly flirted with pricing in another hike but a stumble in retail sales and CPI data left the market settled on 25 bps.

At issue for today is whether the Bank of Canada alters the statement and particularly this line:

"If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases."

I don't see any reason to change it because rate hikes are biting the Canadian consumer and housing market harder than in the US, due to the preponderance of variable-rate debt. However the BOC may want to retain some flexibility after numerous communication missteps in the past under Macklem.

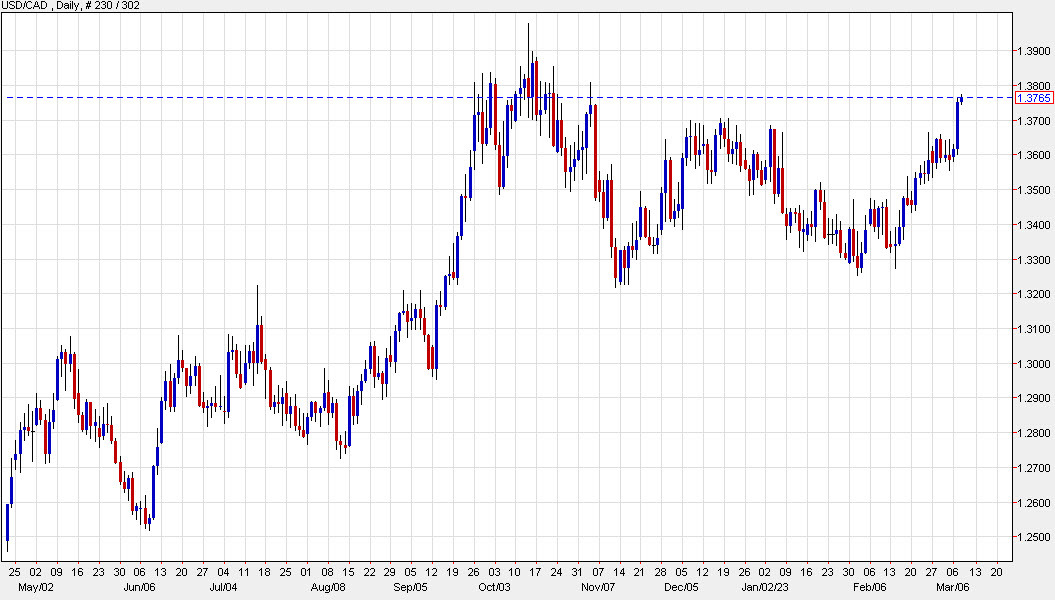

The Bank of Canada may also need to weigh what's happening or could happen with the Canadian dollar as the spread between US and Canadian rates widens. USD/CAD yesterday hit a four-month high and a break into the 1.40s could trigger imported inflation.

Technically, there isn't much standing in the way of a test of the October highs but for the BOC to contribute to the upside, the statement would need to highlight downside economic and inflation risks for Canada.

Later in the year, there's a risk that rate hikes bite hard and the BOC needs to cut. That could be when USD/CAD takes off.

Note that there's no press conference today but -- as per the usual norm -- the BOC has a speech for tomorrow to manage market expectations if they go sideways from what policymakers intend.