- We shouldn't be getting ahead of where the public is without a specific mandate

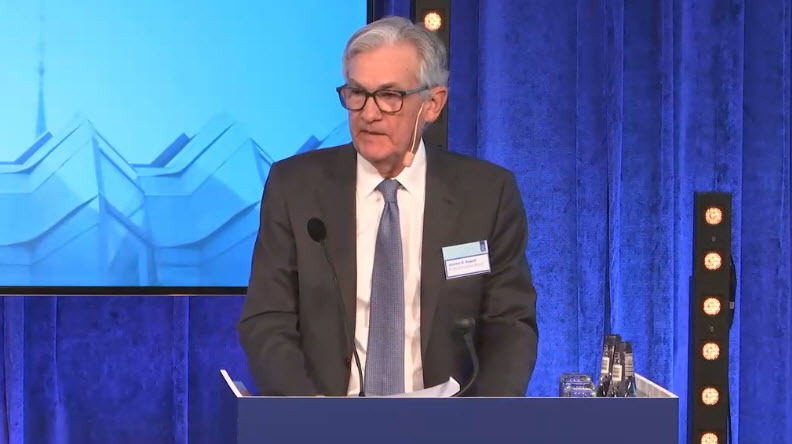

Powell's final comments don't touch on monetary policy. That takes away a big risk today.

Powell's final comments don't touch on monetary policy. That takes away a big risk today.

Most Popular

Supreme Court ruling may trigger $165B tariff refund fight; process could drag for years.

Nikkei 225 futures show mixed price action, with March 2026 contracts up 227 pts. Volume is lower.

Bitcoin's 46.8% drop from ATH presents a buying chance. Regulatory clarity could boost BTC to $100K by 2026.

Trump eyes 10% tariffs via Trade Act after SCOTUS ruling; risks loom for trade deals.

ATM jackpotting nets hackers millions, FBI reports $20M loss in 2025. Rising risks for financial security.

PCE inflation hits 3%, Fed's key gauge shows, fueling market jitters. Watch for rate hike impact!

Active funds beat indexes as AI fears hit software & geopolitics boost oil. Tactical trades pay off.

Must Read