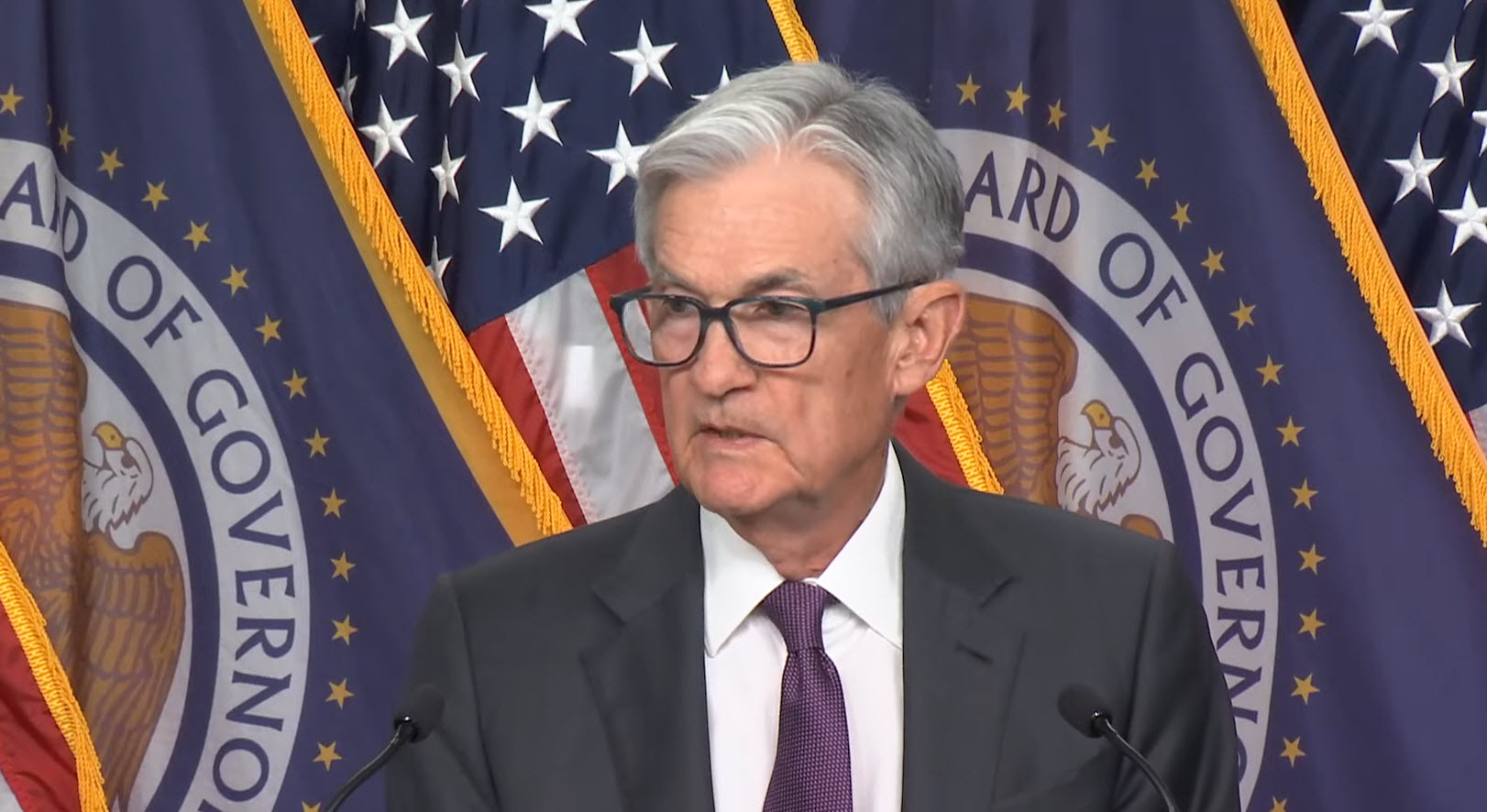

- We will be working to separate tariff from non-tariff inflation

- It's too soon to say if it will be appropriate to look through the effects of tariff inflation

- It will depend on tariff inflation moving through quickly

- The base case is that tariff inflation will be transitory

- It will depend on inflation expectations being anchored

- There is some inertia in changing forecasts among high uncertainty

Team Transitory is re-assembling here. Gold is at a fresh record high, up $11 to $3045.

- We thing the right thing to do is wait for greater clarity about the economy is doing

- With the arrival of the tariffs, further progress on inflation will be delayed

That's not great but the dollar is slumping anyway. Looking at the broader market moves, there was some real angst about a hawkish Fed priced in.

- It's appropriate to wait for some clarity, the costs are low

- Overall labor market is in balance

- "If you look out 5 years or 5-year forward you will see that break evens are either flat or actually slightly down"

- If an inflationary impulse will go away on its own, it's not the right thing to tighten policy

- We are well-aware of what happened with pandemic inflation

- We have to keep in mind that we haven't re-established price stability

- There is always a possibility of a recession, we don't see an elevated chance of a recession

- The chance of a recession has moved up but it's not high

- Says UMich inflation expectations rise is an outlier, but we take notice

Powell -- who leaked a bigger hike after the UMich jump in 2022 -- now says it wasn't that big of a deal. That's rich.

- For right now, the hard data is 'pretty solid'

- We've seen the soft data but we're waiting for clarity

- We will be adapting to policy as we go

- We will know in a couple of months if higher goods inflation in the first two months of the year was from tariffs

- Goods and non-housing services inflation is what they're watching

- We're watching carefully to see if hard data follows drops in sentiment

- Drop in sentiment probably has to do with 'turmoil in the administration'

- This was a good time to slow the shrinking of the balance sheet

- There is no plan to taper MBS runoff, we want it to completely runoff

- We want to stop runoff on net at some point

- Uncertainty is remarkably high

- I don't know any who is confident of their forecast (tell me about it!)

- Change to language around balance of risks was because it had outlived its useful life

- The hard data is still in 'reasonably good shape'

- We don't want to get ahead of the hard data, we don't see it there yet but we should know it fairly quickly

- Some measure of retaliation from tariffs is in our forecasts