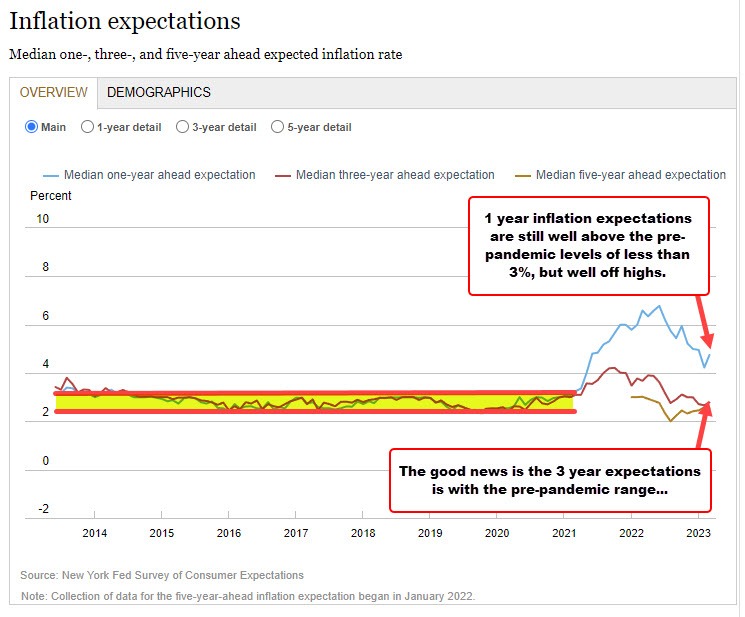

The NY Fed is out with consumer inflation expectations survey:

- 1 year inflation expectations rises to 4.7% from 4.2% last month. First rise in five months

- 3 year expect inflation 2.8% versus 2.7% last month

- 5 year inflation expectations dips to 2.5% versus 2.6% last month

- Share of Americans seeing harder credit access in March highest since 2014

For the report, CLICK HERE.

The short term one year data is not good news for inflation. Pre-pandemic, inflation expectations workers and the 2% – 3% range. However looking at the chart above, the three year inflation expectations is back within the range seen pre-pandemic.

The CPI data in the US will be reported on Wednesday with expectations of 0.2%. The year on year is expected to fall to 5.2% from 6.0%, but core inflation is expected to rise by 0.4%. Traders will continue to watch for the long awaited decline in shelter costs which continued to rise last month by 0.8%.