The non-farm payroll report contained crosscurrents, links to the info from here:

Bank of America acknowledged this in their comments after the data:

- The ambiguity of the report make it difficult to parse. We think it is just soft enough for the Fed to justify a hold in June

Morgan Stanley is in the same camp:

- We do not believe today's report was strong enough to meet the bar for the Fed to hike in June, but raises the risk that the Fed could hike in July

And add:

- While payroll numbers were undeniably strong, the FOMC will also be focused on the unemployment rate. The FOMC tends to operate under the law of inertia, once it stops it will be difficult to start hiking again.

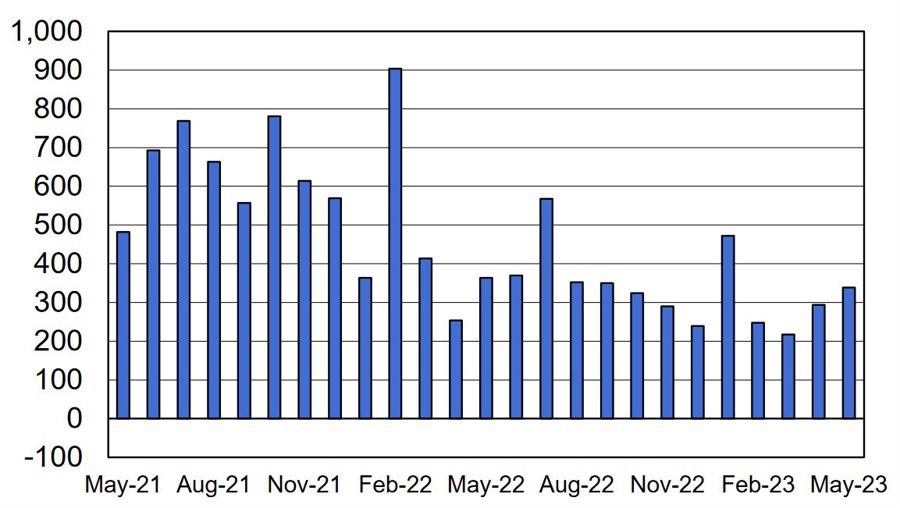

May nonfarm payrolls beat again.