The latest weekly update from BlackRock, the world's largest asset manager.

In (very, very) brief the firm says in summary:

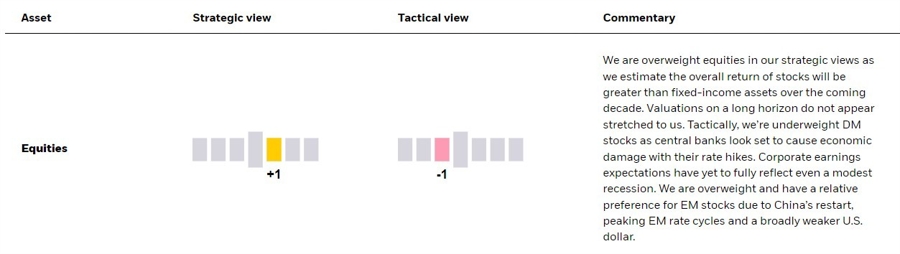

Tweaking our views

- Markets are waking up to our expectation of more central bank rate hikes as inflation proves sticky. We go overweight U.S. short-term bonds for income.

Market backdrop

- U.S. two-year Treasury yields jumped near 15-year highs – sparking an equity retreat – as Federal Reserve rate cuts later in the year were priced out.

Week ahead

- Flash PMIs will show if activity is proving resilient at the start of the year. The PCE inflation data may confirm core inflation is staying persistently high.