- There was a concern on council not to rush into decisions

- It is important to be attentive to conditions

- We will be data dependent

- UK has had a history of much higher inflation than us

- The BOE is hiking because of a negative labour supply shock due to Brexit

- Critical difference between the UK and us is the labor market, says workers left during pandemic

- Our March meeting and, critically, our June meeting will be essential for evaluating our guidance

- We are no longer in a low inflationary environment

- Inflation is getting much closer to target

- Inflation in January was very surprising

- Won't hike rates until net QE purchases have stopped

- Inflation might be significantly higher than expected this year

- Spreads haven't widened in a significant manner, and if they do we have all the tools to respond

- The 3% decline in the euro in the last 12 months is a very small factor in higher eurozone energy prices

Lagarde has been hawkish and the euro has jumped. German 10-year bund yields are up 5.8 bps to 0.10%.

She raised expectations that something could be decided in March about monetary policy because of surprises on inflation. She also backtracked a bit on no rate increases in 2022. Market pricing now suggests a 20 bps hike by Sept, up from 10 bps previously.

A 10 bps hike is now priced for June and 40 bps by year-end. This is a major repricing.

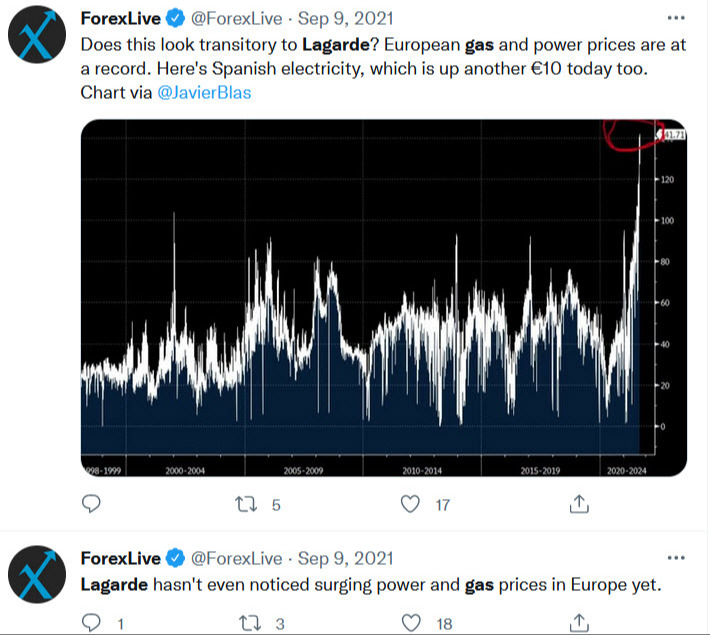

Lagarde was defending her forecasts, saying no one say high energy prices coming but I look back to the September meeting when she was entirely oblivious to what was happening in natural gas prices then and entirely dismissive of energy inflation.