I posted earlier on:

Separately from the firm, a slightly different take:

- "It might be premature to believe that recession is off the table now, when Fed will have done 500bp+ of tightening in a year, and the impact of monetary policy tended to be felt with a lag on the real economy, of as much as 1-2 years"

Markets are unlikely to hit bottom until the Fed ends its aggressive interest-rate hike campaign and begins to cut:

- "Historically, equities do not typically bottom before the Fed is advanced with cutting, and we never saw a low before the Fed has even stopped hiking"

- "The damage has been done, and the fallout is likely still ahead of us."

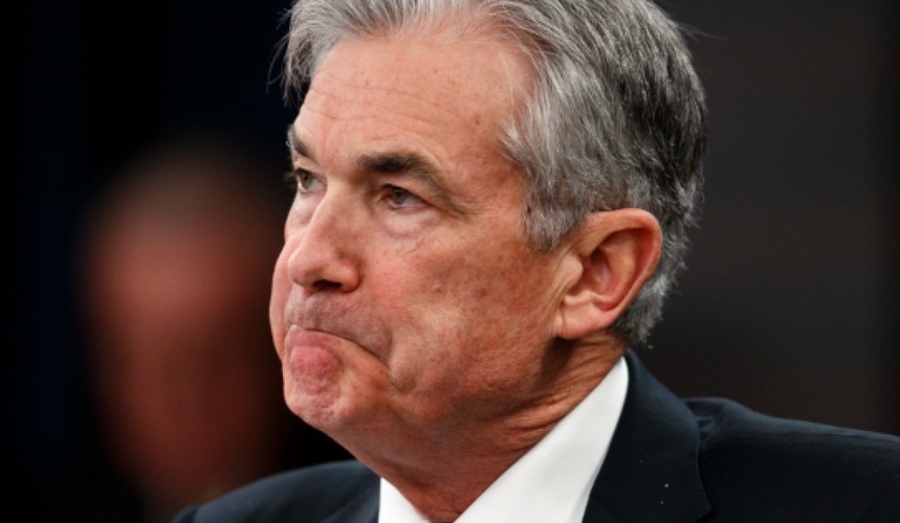

Federal Reserve Chair Powell. Not done yet.