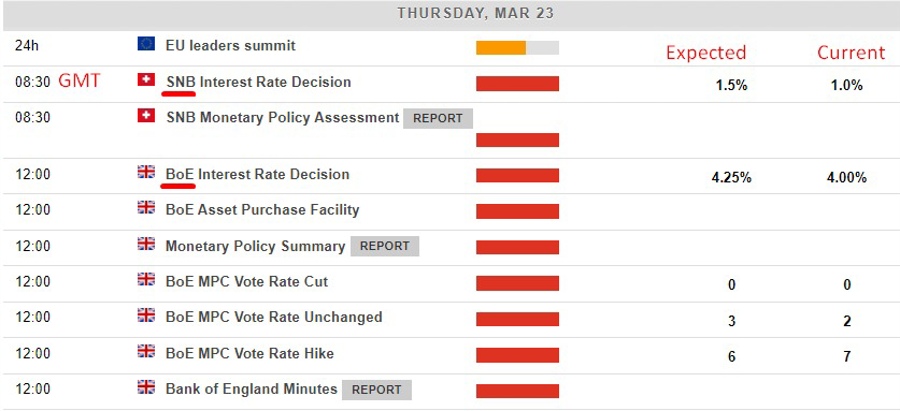

Not a lot for the Asia time zone today but once early Europe kicks off, a big session:

Those times above in US Eastern time are, respectively

- 4.30 am

- 8 am

Not a lot for the Asia time zone today but once early Europe kicks off, a big session:

Those times above in US Eastern time are, respectively

Most Popular

Intel beat Q4 earnings & revenue forecasts, with margins well above expectations. However, Q1 guidance disappointed, breakeven EPS & a weaker revenue and margin outlook, tempering near-term sentiment despite strength in Datacenter and Foundry units.

Trump's $200B housing plan offers marginal rate cuts; supply issues persist. Geopolitics may hike borrowing costs.

CD rates up to 5% APY, but Fed rate cuts loom. Lock in now or risk lower returns. Compare options!

Trade tensions ease! LXFR, CTOS, TEX jump 3%+ on Greenland deal framework. LXFR hits 52-wk high, but 5-yr return is negative.

Black swan risks: Iran oil shock (38% chance yields rise then fall), China tech breakthrough (coin-toss bubble burst), Russia/NATO war hits US GDP.

RDW jumps 17.6% on Greenland deal hopes; LASR +5%, DDD +9%, BLNK +7.9%, GLDD +8%. Trade fears ease.

Geopolitical relief sparks rally! AKAM +3.4%, APPN +2.9%, TTD +3.6%. TTD trades 70% below 52-wk high.

Must Read