The US dollar jumped after Atlanta Fed President Raphael Bostic signalled openness to pausing in November if the data supports it.

“I am totally comfortable with skipping a meeting if the data suggests that’s appropriate," he told the WSJ.

With that, the implied odds of the Fed pausing rose to 22% from 7% following today's CPI and jobless claims data. It wasn't a throw-away line either as he specifically mentioned today's CPI report.

"This choppiness to me is along the lines of maybe we should take a pause in November. I’m definitely open to that,” Bostic said. “I think we have the ability to be patient and wait and let things play out a little longer…. There are elements of today’s report which I think validate that view.”

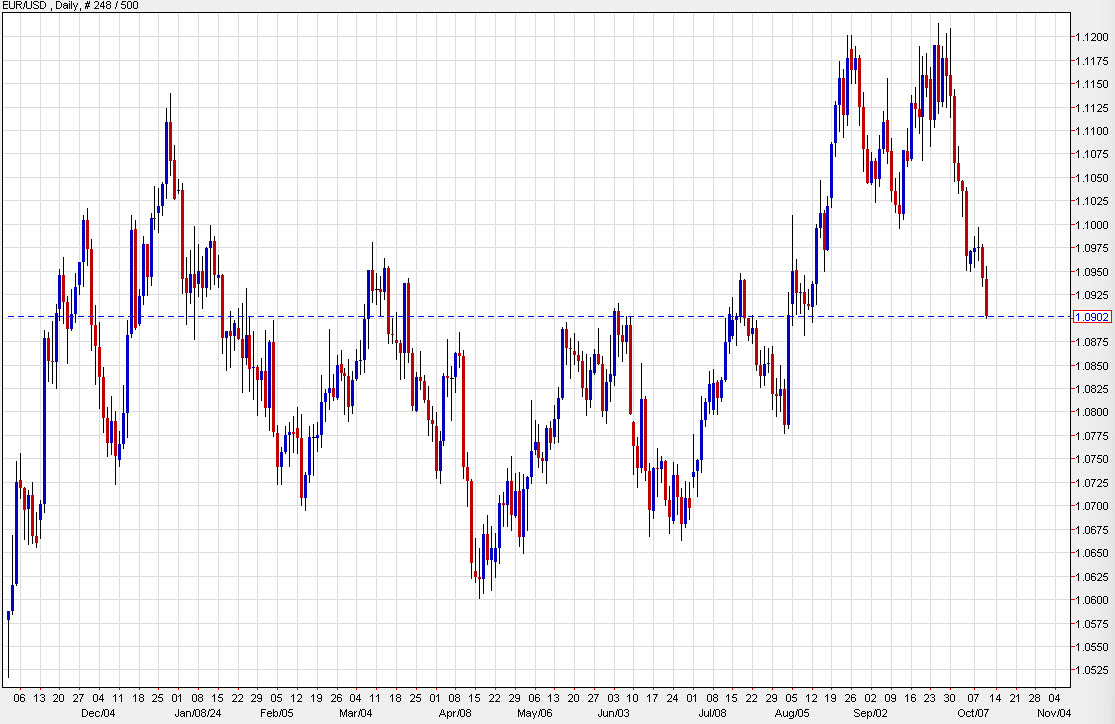

The dollar is broadly higher on the comments and stocks sold off. EUR/USD is trading at the worst levels of the day, down 40 pips. It's also at a two-month low.