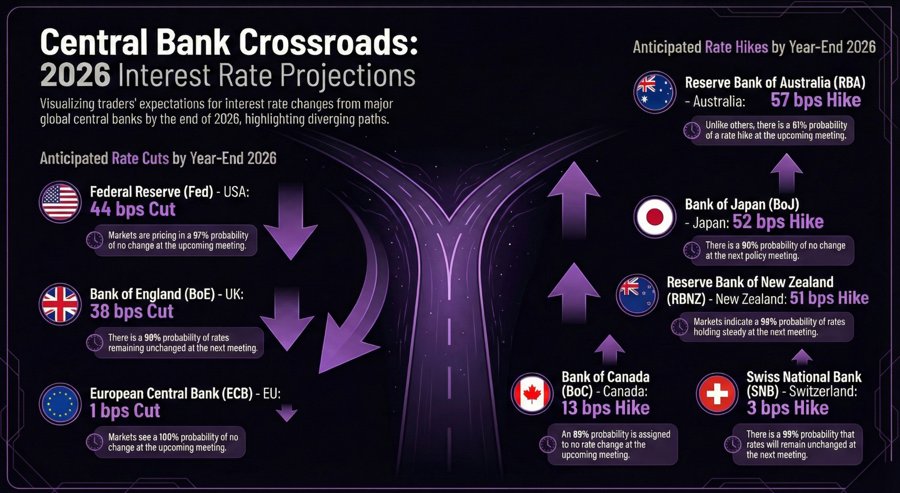

Rate cuts by year-end

- Fed: 44 bps (97% probability of no change at the upcoming meeting)

- BoE: 38 bps (98% probability of no change at the upcoming meeting)

- ECB: 1 bps (100% probability of no change at the upcoming meeting)

Rate hikes by year-end

- BoC: 13 bps (89% probability of no change at the upcoming meeting)

- BoJ: 52 bps (90% probability of no change at the upcoming meeting)

- RBA: 57 bps (61% probability of rate hike at the upcoming meeting)

- RBNZ: 51 bps (99% probability of no change at the upcoming meeting)

- SNB: 3 bps (99% probability of no change at the upcoming meeting)

You can find last week's market pricing here.

It's been a lively trading week thanks to Trump's TACO trade and a few surprises on the economic data front. The main event was Trump's speech at the World Economic Forum in Davos as traders were waiting for him to de-escalate the recent trade war over Greenland.

He did exactly that by announcing on Truth Social that he reached a "framework" of a deal for Greenland and that he won't impose the tariffs anymore. That triggered a slightly hawkish repricing across the board as risk sentiment picked up.

The following day we got a blockbuster Australian jobs report where the unemployment rate fell to 4.1% vs 4.4% expected. The Australian Dollar surged across the board as traders firmed up expectations for a rate hike already at the upcoming meeting and raised the total tightening by year-end.

The same day we got strong US Jobless Claims data and higher than expected New Zealand Q4 CPI report. Both the releases led to a hawkish repricing, although it was stronger for the RBNZ.

Lastly, today the highlights were the BoJ decision and the UK Flash PMIs. The Bank of Japan held interest rates steady and slightly upgraded growth and inflation forecasts leading to a small hawkish repricing. What caught the market attention though is that after the USD/JPY pair crossed the 159.00 level, the price got smacked back down by 200 pips in a couple of seconds in a suspected intervention.

The UK Flash PMIs surprised with much stronger than expected figures. The S&P Global highlighted that it was the "strongest upturn in UK private sector business activity since April 2024" and "intensification of price pressures at a level above the Bank of England target". The GBP rose following the release as traders pared back the BoE rate cut bets.

We still have the US Flash PMIs coming up in the afternoon, and that could be a market-moving event if we get very strong or soft data.