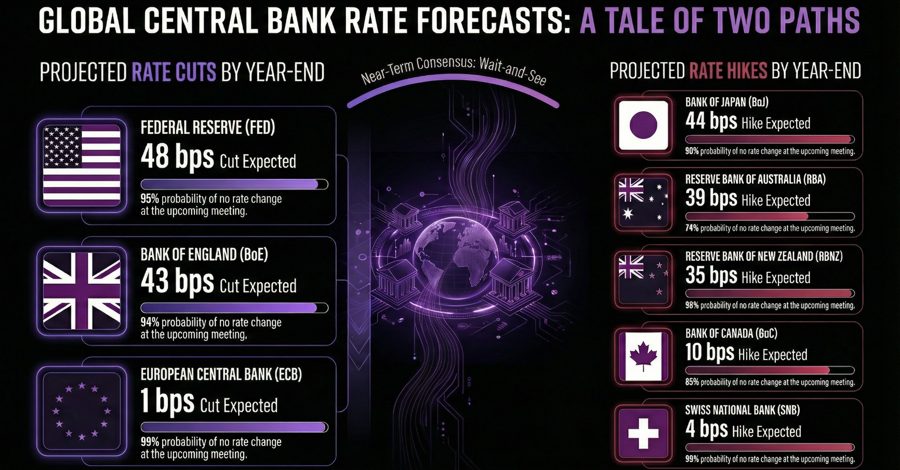

Rate cuts by year-end

- Fed: 48 bps (95% probability of no change at the upcoming meeting)

- BoE: 43 bps (94% probability of no change at the upcoming meeting)

- ECB: 1 bps (99% probability of no change at the upcoming meeting)

Rate hikes by year-end

- BoC: 10 bps (85% probability of no change at the upcoming meeting)

- BoJ: 44 bps (98% probability of no change at the upcoming meeting)

- RBA: 39 bps (74% probability of no change at the upcoming meeting)

- RBNZ: 35 bps (98% probability of no change at the upcoming meeting)

- SNB: 4 bps (99% probability of no change at the upcoming meeting)

The most notable repricings happened on the Fed and BoJ fronts. The softer than expected US core inflation data on Tuesday triggered a slightly dovish repricing taking the total easing by year-end to 54 bps vs 51 bps before the release. Those bets were erased yesterday after the strong US jobless claims data. The total easing fell to 48 bps from 54 bps prior.

On the BoJ side, we got a slightly hawkish repricing following a Bloomberg report saying that the BoJ officials were paying more attention than before on the weakening yen and its potential impact on inflation. According to people familiar with the matter, this might have implication for future rate hikes even though the central bank is likely to hold rates steady next week.