Analysts at Goldman Sachs say that while inflation pressures are currently high they are seeing indications that the outlook for UK CPI over the medium term is looking softer, citing:

- growth has weakened markedly, and GS expect this to continue, forecasting only 0.9% growth for 2025

- household real disposable income growth likely to slow

- rising trade tensions are likely to weigh on activity

- underlying cooling in the labour market, will slow wage growth

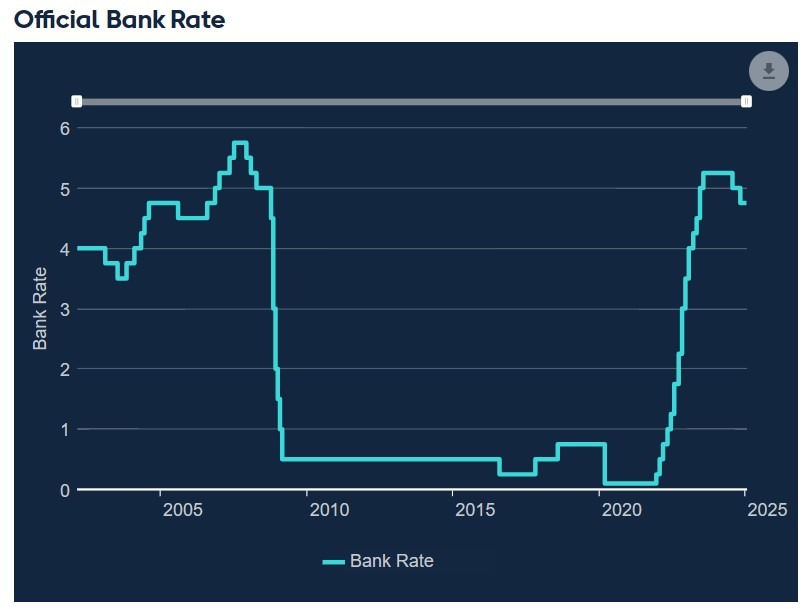

GS projects the BoE's Bank rate will drop to 3.25% by the middle of 2026:

- While it is possible that the Bank of England will slow the pace of cuts if underlying inflation fails to make progress, we believe that a step-up to a sequential pace of cuts in response to weaker demand is actually more likely

Bank of England Bank Rate currently. The Monetary Policy Committee next meet on February 6. A rate cut of 25bp is expected.