This is via the folks at eFX.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.

- Goldman Sachs discusses its new Fed call in light of yesterday's FOMC policy decision.

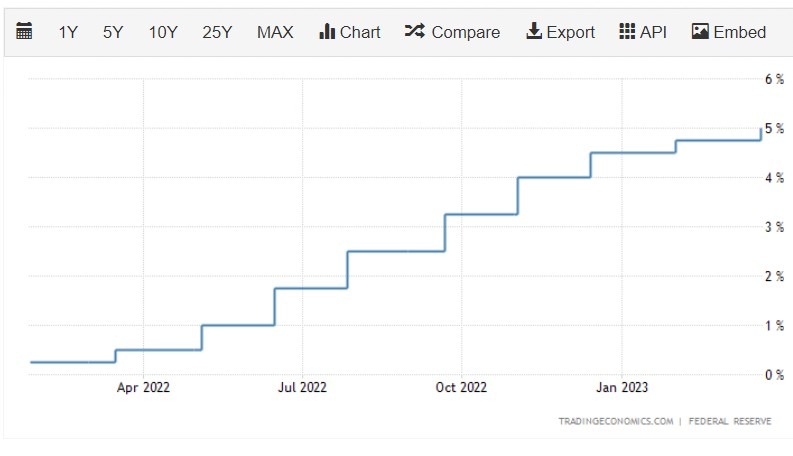

- "The FOMC raised the funds rate by 25bp today to 4.75-5%, against our expectation of a pause, but projected a weak economic outlook for the rest of 2023 and a more cautious path for the funds rate than Chair Powell had indicated was likely before the recent banking turmoil," GS notes.

- "We have left our forecast for the peak funds rate unchanged at 5.25-5.5% and now expect additional 25bp rate hikes in May and June. Our baseline forecast is 25bp above the FOMC's forecast of 5-5.25%, and our weighted-average path for the funds rate is above market pricing " GS adds.

---

Passing this on as an update, GS with the call yesterday.

Graph from Trading Economics: