The FOMC minutes stated that Jerome Powell was selected to serve as Chair for 2026, with the appointment lasting until a successor is formally chosen.

In practical terms, that means Powell would continue to preside over the FOMC, including at meetings later than May, provided he remains a Federal Reserve Governor and the incoming Chair (Kevin Warsh) has not yet been confirmed and installed.

The language in the minutes serves as a reminder of the Committee’s standard governance framework: the sitting Chair remains in place by default until a confirmed successor officially assumes the role.

Summary:

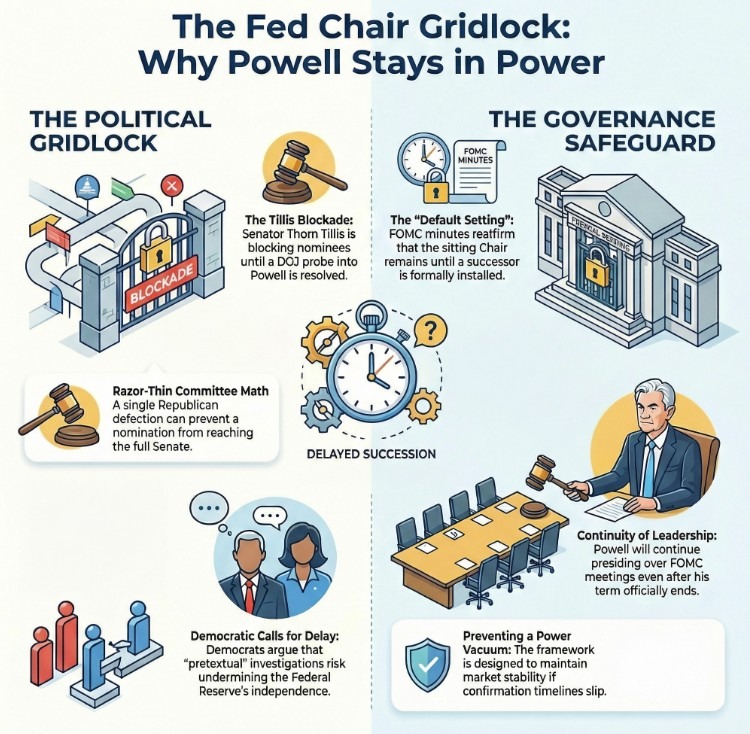

FOMC minutes reaffirm Powell as chair “until a successor is selected,” a key governance default.

Warsh’s confirmation timeline is at risk of slipping, creating a longer “interim chair” window.

Sen. Thom Tillis is threatening to block Fed nominees until the DOJ probe into Powell is resolved.

Democrats are also pressing to delay proceedings, arguing investigations undermine confidence in the process.

Bottom line: Powell remains FOMC chair by default until a successor is confirmed and formally in place.

FOMC minutes underscore a core governance reality that can get lost in the politics of Fed succession: the sitting chair remains chair until the successor is formally selected and installed. The minutes’ officer-election language is effectively a “default setting,” designed to prevent a vacuum if confirmation timing slips.

Why does that matter now? Because the next-chair process looks unusually messy. President Trump has said Kevin Warsh is his pick to succeed Jerome Powell when Powell’s chair term ends in mid-May. But Warsh may not be confirmed in time, not necessarily because the Banking Committee chair is blocking him, but because a key Republican vote may be unavailable.

Republican Sen. Thom Tillis (North Carolina), who sits on the Senate Banking Committee, has publicly tied his support for any Federal Reserve nominees to the outcome of a Justice Department investigation involving Powell. Tillis has framed the probe as an attack on Fed independence and has said he won’t allow nominees to advance until the matter is resolved.

That matters because committee math is tight. If Democrats line up against Warsh in committee, a single Republican defection can prevent the nomination from being voted out to the full Senate. Reporting has explicitly highlighted Tillis’s hold as an early hurdle for Warsh’s timeline.

Complicating things further, Senate Banking Committee Democrats have also pushed for nomination proceedings to be delayed until what they describe as “pretextual” investigations involving Fed officials are closed, arguing the optics risk undermining confidence in the Fed’s independence.

There have been signs of a possible procedural workaround, including the idea of proceeding with hearings even if a committee vote is held up, but the core point remains: if the nomination is delayed in committee or the White House nomination paperwork arrives late, the transition window stretches.

That’s where the minutes’ governance reminder becomes market-relevant. In a prolonged transition, Powell remains the de facto FOMC chair “until he’s not,” and uncertainty shifts from who is chair today to how politicised and protracted the handover becomes, especially with Fed-independence narratives already live.