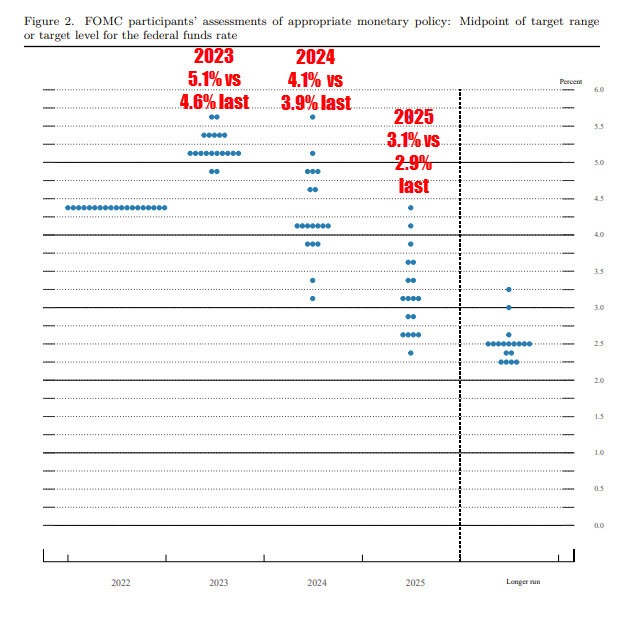

- The dot plot from December 2022 shows the median rate at the end of 2023 at 5.1% vs 4.6% at the September 2022 projection

- For 2024, the median fed funds target rate is 4.1% versus 3.9% in September

- For 2025, the median fed funds target rate is 3.1% versus 2.9%

The dot plot from December 2022:

DotPlot for December 2022

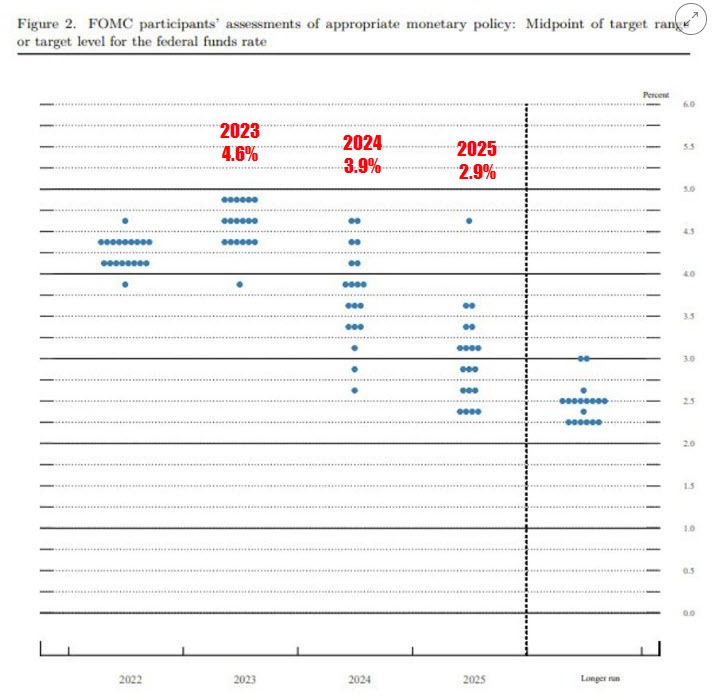

The dot plot from September 2022:

Dot plot from September 2022

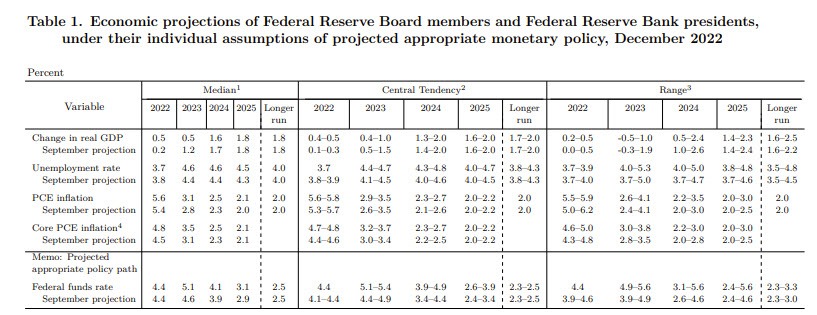

The table of central tendencies from December 2022 shows:

Central tendencies for December 2022

Highlights from the central tendencies

- PCE inflation higher to 2.9% – 3.5%. Up from 2.6% – 3.5% in September

- core PC higher: 3.2% – 3.7% above the 3.0% – 3.4% in September

- unemployment rate in 2023 is expected be higher 4.4% – 4.7% up from 4.1% – 4.5%

- GDP is expected to be lower at 0.4% – 1.0%

Overall more bearish as the Fed expects the terminal rate to be higher than market expectations prior to the report. Also they expect lower growth, and higher inflation.